Published: 20 January 2022

CQC Annual report and accounts (ARA) 2020 to 2021

Part 2: Accountability report

This section contains:

- Corporate governance report

- Remuneration and people report

- Parliamentary accountability and audit report

- Certificate and report of the Comptroller and Auditor General to the Houses of Parliament

Corporate governance report

The corporate governance report provides an explanation of how the organisation is governed, how this supports our objectives and how we make sure that there is a sound system of internal control allowing us to deliver our purpose and role.

Director's Report

CQC’s Board

The Board has key roles that are set out in legislation and in our framework agreement with DHSC. These are reflected in our corporate governance framework and other related governance documents. There have been no significant departures from the processes set out in these documents during the year.

Our unitary Board is made up of our Chair (Peter Wyman) and up to 14 Board members, the majority of whom must be non-executive members. The current composition of the Board, excluding the Chair, is six non-executive members, one associate non-executive member, our Chief Executive (who is also the Accounting Officer), our three Chief Inspectors, and our Chief Operating Officer. One of our non-executive directors (Mark Saxton) acts as the Senior Independent Director.

Membership of the Board changed during the year. Terms of appointment for non-executive directors John Oldham, Paul Rew and Liz Sayce came to an end on 31 July 2020, 30 December 2020 and 31 January 2021 respectively. Sally Cheshire, Mark Chambers and Stephen Marston were appointed as non-executive directors from 4 January 2021, and Ali Hasan was appointed as an associate non-executive director, also from 4 January 2021. Another new non-executive director, Belinda Black, will take up her appointment from 1 May 2021. In light of these changes, it is intended that a Board effectiveness review will be held in summer 2021. The membership and attendance at meetings is detailed in the file 'ARA 2020 to 2021: Board and committee membership and attendance' below:

ARA 2020 to 2021: Board and committee membership and attendance

See biographies of all our Board members and view their declarations of interest

The Board carries out a range of business in line with its main responsibilities, which are to:

- provide strategic leadership to CQC and approve the organisation’s strategic direction

- set and address the culture, values and behaviours of the organisation

- assess how CQC is performing against its stated objectives and public commitments.

During the pandemic, the Board has been unable to meet face-to-face but meetings have continued to take place online. The Board meets both in public and private session throughout the year and the public sessions have been recorded and are available to view on CQC’s website following each meeting. From April 2021, public sessions were live streamed as well as being recorded. At each of its meetings, the Board receives performance data setting out the current performance and financial position, and details of activity to address where performance is under business plan targets. The Board has the opportunity to scrutinise and discuss the data during these meetings.

Feedback from Board members confirms that papers and data reviewed by the Board are of a good standard and well received. In addition, further digital and intelligence development has allowed for a greater range of data and more effective analysis to be made available for regular items such as performance reporting. The Board receives reports on information and cyber security risk at each of its meetings and there have been no significant information or cyber security incidents to report over the course of the year.

The Board has continued its commitment to achieving levels of governance that we would expect of providers when assessing whether they are well-led. It has done this by providing oversight and challenge on key issues. Over the year, this has included: oversight of our ongoing response to the pandemic, including the initial emergency response, development and implementation of the transitional model and the assessment of its effectiveness; and oversight of our financial and business planning and the seeking of assurance around related controls, directly in Board and through the scrutiny of the Audit and Corporate Governance Committee (ACGC). Through the Regulatory Governance Committee, and directly in Board, the Board seek assurance that systems, process and accountabilities are in place for identifying and managing risks associated with delivering the regulatory programme.

Statement of Accounting Officer’s responsibilities

Under the Health and Social Care Act 2008, the Secretary of State for Health and Social Care has directed CQC to prepare for each financial year a statement of accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of CQC and of its net resource outturn, application of resources, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual (FReM) and in particular to:

- observe the Accounts Direction issued by the Secretary of State for Health and Social Care, including the relevant accounting and disclosure requirements, and apply suitable accounting policies on a consistent basis

- make judgements and estimates on a reasonable basis

- state whether applicable accounting standards as set out in the FReM have been followed, and disclose and explain any material departures in the financial statements, and

- prepare the financial statements on a going concern basis.

The Secretary of State for Health and Social Care has appointed the Chief Executive as the Accounting Officer of CQC. My responsibilities as Accounting Officer, including responsibility for the propriety and regularity of public funds and assets vested in CQC, and for keeping proper records, are set out in Managing Public Money, published by HM Treasury.

As Accounting Officer, I can confirm that:

- There is no relevant audit information of which CQC’s auditors are unaware.

- I have taken all steps I ought to have taken to make myself aware of any relevant audit information and to establish that CQC’s auditors are aware of that information.

- The annual report and accounts as a whole are fair, balanced and understandable.

- I take personal responsibility for the annual report and accounts and the judgements required for determining that it is fair, balanced and understandable.

Governance statement

CQC’s governance framework and structures

We have a corporate governance framework that describes the governance arrangements of the organisation and how they help make sure that our leadership, direction and control enables long-term success. See our corporate governance framework in full.

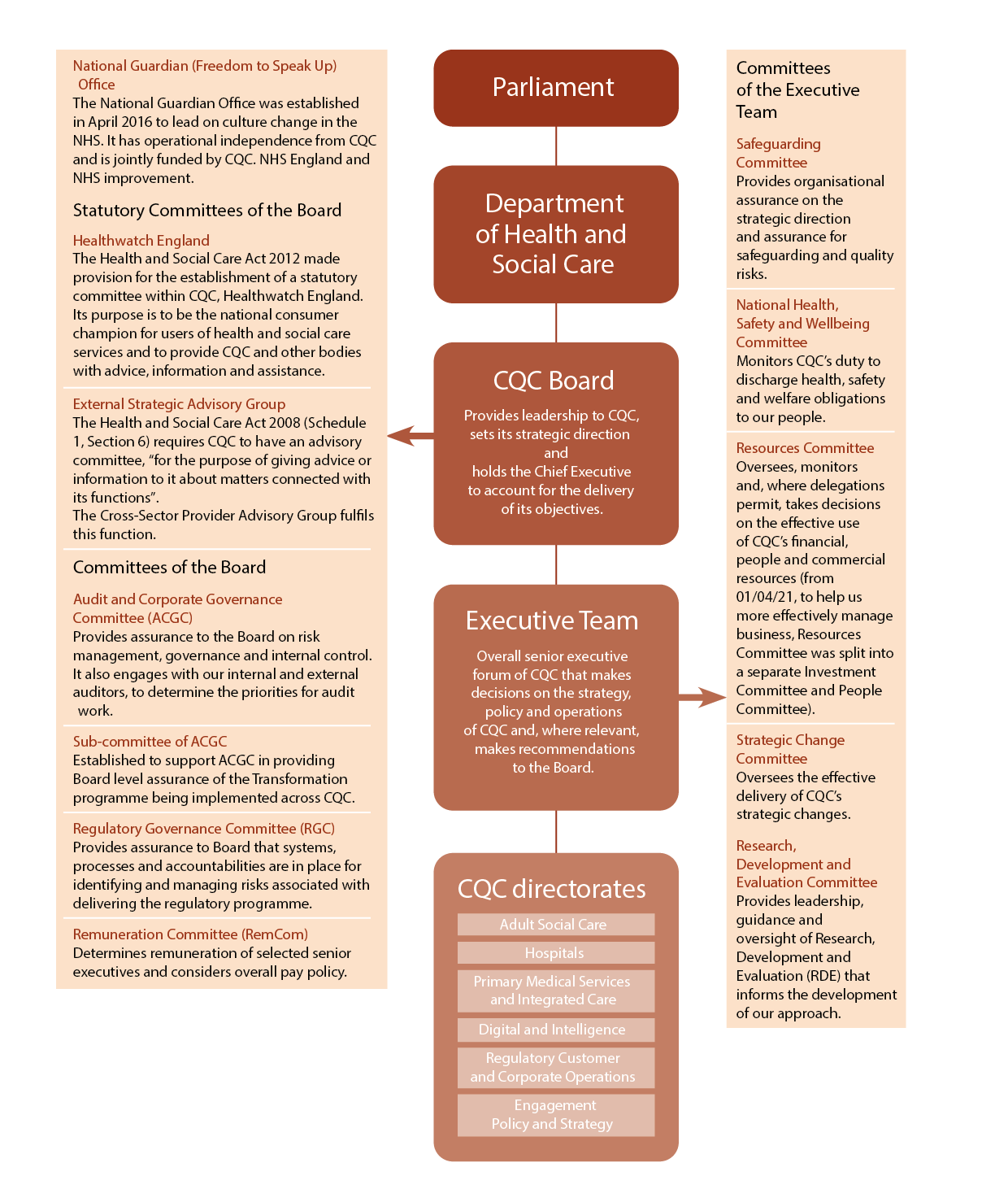

CQC's governance structure

CQC's governance structure

There are five levels within the overall CQC governance structure:

Level 1: Parliament

Level 2: Department of Health and Social Care (DHSC)

Level 3: CQC Board

Provides leadership to CQC, sets its strategic direction and holds the Chief Executive to account for the delivery of its objectives.

National Guardian (Freedom to Speak Up) Office

The National Guardian Office was established in April 2016 to lead on culture change in the NHS. It has operational independence from CQC and is jointly funded by CQC. NHS England and NHS improvement.

Statutory Committees of the Board

Healthwatch England

The Health and Social Care Act 2012 made provision for the establishment of a statutory committee within CQC, Healthwatch England. Its purpose is to be the national consumer champion for users of health and social care services and to provide CQC and other bodies with advice, information and assistance.

External Strategic Advisory Group

The Health and Social Care Act 2008 (Schedule 1, Section 6) requires CQC to have an advisory committee, “for the purpose of giving advice or information to it about matters connected with its functions”. The Cross-Sector Provider Advisory Group fulfils this function.

Committees of the Board

Audit and Corporate Governance Committee (ACGC)

Provides assurance to the Board on risk management, governance and internal control. It also engages with our internal and external auditors, to determine the priorities for audit work.

Sub-committee of ACGC

Established to support ACGC in providing Board level assurance of the Transformation programme being implemented across CQC.

Regulatory Governance Committee (RGC)

Provides assurance to Board that systems, processes and accountabilities are in place for identifying and managing risks associated with delivering the regulatory programme.

Remuneration Committee (RemCom)

Determines remuneration of selected senior executives and considers overall pay policy.

Level 4: Executive Team

Overall senior executive forum of CQC that makes decisions on the strategy, policy and operations of CQC and, where relevant, makes recommendations to the Board.

Safeguarding Committee

Provides organisational assurance on the strategic direction and assurance for safeguarding and quality risks.

National Health, Safety and Wellbeing Committee

Monitors CQC’s duty to discharge health, safety and welfare obligations to our people.

Resources Committee

Oversees, monitors and, where delegations permit, takes decisions on the effective use of CQC’s financial, people and commercial resources (from 01/04/21, to help us more effectively manage business, Resources Committee was split into a separate Investment Committee and People Committee).

Strategic Change Committee

Oversees the effective delivery of CQC’s strategic changes.

Research, Development and Evaluation Committee

Provides leadership, guidance and oversight of Research, Development and Evaluation (RDE) that informs the development of our approach.

Level 5: CQC directorates

There are six directorates within CQC:

- Adult Social Care

- Hospitals

- Primary Medical Services and Integrated Care

- Digital and Intelligence

- Regulatory Customer and Corporate Operations

- Engagement Policy and Strategy

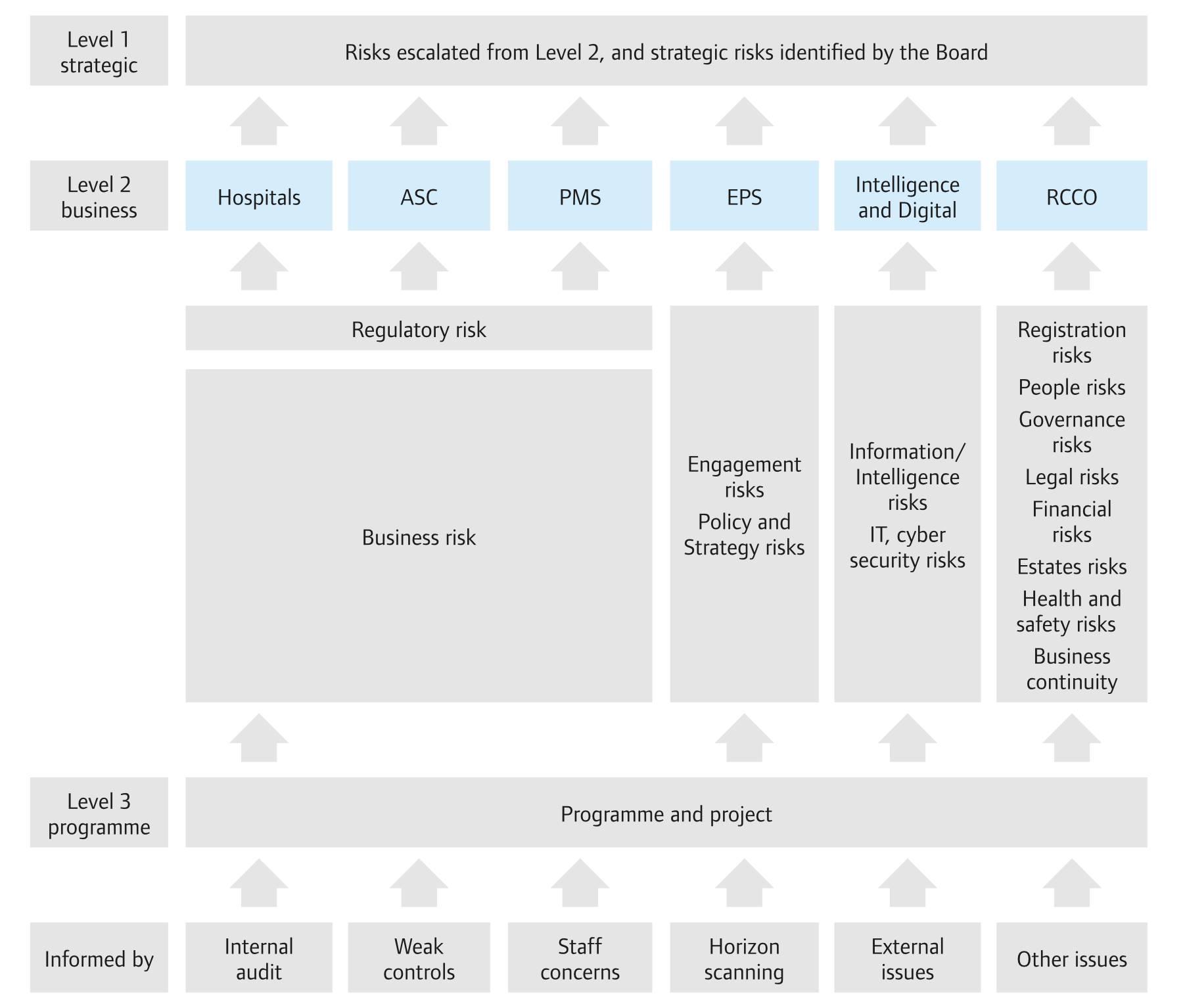

Risk management

We see the effective management of risks to the delivery of our purpose (enterprise, or corporate risk) as critical to our assurance and governance. Our corporate risk framework covers the identification and management of risks to the delivery of our purpose, strategy and business plan. We use the three lines of defence model in managing, monitoring and independently assuring risk. We have an agreed tolerance statement which defines the key types of risk we face, and the appropriate tolerances for each. We maintain a strategic and high-level corporate risk register of the risks that the Board and ET have identified which is regularly reviewed and monitored. Risk reporting occurs at various levels across CQC and ensures appropriate escalation and mitigation of risks at all times. DHSC regularly reviews the CQC corporate risk register in accountability meetings and periodically in its Audit and Risk Committee.

CQC's risk escalation process

This diagram below outlines CQC's risk escalation process through risk management levels

The diagram shows 4 stages. These are where risks are identified or levels to which they are escalated. As the diagram illustrates a process of upward escalation, this text version describes it from bottom to top.

Bottom row - informed by:

- internal audit

- weak controls

- staff concerns

- horizon scanning

- external issues

- other issues

These sources are escalated to level 3.

Level 3: programme and project level

From programme and project level, risks are escalated to level 2.

Level 2: business

- Regulatory or business risks are escalated to the Hospitals, Adult Social Care or Primary Medical Services directorates.

- Engagement risks and policy and strategy risks are escalated to the Engagement, Policy and Strategy directorate.

- Information/intelligence risks and IT and cyber security risks are escalated to the Intelligence and Digital directorate.

- Registration risks, people risks, governance risks, legal risks, financial risks, estates risks, health and safety risks and business continuity risks are escalated to the Regulatory, Customer and Corporate Operations directorate.

From here, risks are escalated to level 1.

Level 1: strategic

Risks escalated from level 2, and strategic risks identified by the Board.

During the pandemic we have continued to review our risks and have planned for and managed both COVID and non–COVID risks, including:

- The risk of delaying in-person inspections and being mainly limited to remote inspections, and of not having an effective intelligence-led approach to underpin this, meaning there was a risk that poor practice and patient harm goes undetected. This is against the background of providers potentially finding it harder to maintain standards during the pandemic.

- A failure to adapt our regulatory model to the pace of change in health and social care organisation, for instance the focus on integrated care and place, and changes in care pathways with accelerated changes triggered by the COVID response.

- Financial pressures causing a deterioration in quality of adult social care services, making it more difficult for CQC to deliver its purpose to ensure quality of care for people.

- The potential challenges for well-being of our own people from the impact of COVID-19, including home working, potential for isolation, etc.

- Delivering a challenging change programme.

- Developing a credible new strategy.

- Information and cyber security risks.

- The UK’s relationships with the EU and the rest of the world. This impacts on processes for the health and care system, including the recruitment and retention of a skilled health and care workforce; access to medicines, medical goods and non-medical consumables; and arrangements for reciprocal healthcare.

Management assurance

We have a management assurance framework designed to seek assurance from all parts of the organisation that internal controls are working effectively and to identify areas of concern.

There are six management assurance areas:

- Performance planning and risk

- Financial management systems and controls

- People management and development

- Information and evidence management

- Continuous improvement

- Governance and decision-making.

We have improved our management assurance process – updating the standards and making the evidence required for meeting them clearer. The assessments this year reset our picture of management assurance and establish a new baseline from which to gauge future progress.

What do the assessments tell us?

61% of the standards across all six areas are green (fully met); 37% are amber (partly met); and 2% are red (not met).

The areas with most green standards are: Financial management systems and controls (76%); Information and evidence management (75%); and Governance and decision making (75%). Those with fewer are: Continuous improvement (54%); Performance planning and risk (50%); and People management and development (48%).

Management controls and responding to the challenges of the pandemic

During the pandemic, we established mechanisms for swift decision-making, as required. This has been kept under review and adapted according to changing risk in the areas we regulate.

The ability to implement the agreed business plan for 2020 to 2021 was significantly challenged as a result of the pandemic. However, we adapted our regulatory approach in the light of this and reviewed and communicated fresh organisational priorities at the mid-year point. A further review of priorities took place during February and March.

Financial controls were monitored closely during the year. Financial delegations remained the same during COVID-19 and contingency plans were in place to ensure payments could still be made. Aged debt, working capital cover and projected income were monitored weekly and reported to our gold command senior management oversight group.

Significant work took place to ensure the stability and performance of our supply chain during both the pandemic and Brexit. We supported the national PPE programme and worked full time within the DHSC PPE teams to help source critical items in the early stages of the pandemic for use by health and social care providers. Also, we sourced a range of PPE and homeworking solutions to allow our employees to continue to operate safely and effectively during this time.

The impact of the pandemic on our people’s working lives, like the rest of the working population, was significant. We set out from the start of the pandemic to ensure people were effectively supported. This included risk assessments, provision of PPE, training/learning about COVID-19, provision of office equipment for home working, as well as support for wellbeing from managers and colleagues.

Other use of management controls

We have three Freedom to Speak Up guardians, supported by around 70 speak up ambassadors. We champion the importance of speaking up across the organisation and support a culture of openness where staff are encouraged and supported to speak up. In 2020 to 2021 there were 40 recorded concerns/cases reported through the speak up route. Of these, 50% were enquiries to Ambassadors or Guardians which were resolved by advice, signposting and/or informal routes for mediation. The remaining 50% were either informally investigated by the Guardians or joint work was undertaken with HR where there was either a formal process followed or advice given. One contact resulted in a whistleblowing investigation. Our Guardians regularly report to the CQC Board on their work. In 2021 to 2022 they plan to focus more on the outcomes from speaking up to ensure any learning or change that comes from speaking up is embedded and sustained.

Information governance and security (including cyber security) are important areas of focus at CQC. Like previous years, there has been ongoing improvement work throughout 2020 to 2021, driven by our information governance working group. There has also been ongoing work to ensure that changes to working practices introduced in response to the global pandemic are secure and lawful.

Security incident analysis and response has continued throughout 2020 to 2021 and is reported to CQC’s senior information risk owner (SIRO) and the ACGC. The number of incidents reported and investigated during the year was consistent with that of previous years. They were low-level incidents where no harm or distress was caused.

On matters of information security and privacy, we have continued to liaise with the DHSC, NHSE&I, NHS Digital and the Information Commissioner’s Office. We did not have any data security breaches that we were required to report to the ICO in 2020 to 2021.

In the area of counter-fraud, the number of allegations of fraud received during 2020 to 2021 has continued to be very low, with four cases reported and investigated. Those cases contained allegations of corruption or conflict of interest. Following thorough investigation, no allegation was substantiated.

Pay Controls

During the year we incurred a liability from the NHS pension scheme upon the retirement on an individual who had been on an external secondment with an increased salary (which has been disclosed as a loss in table '1.1 Losses' from this report). The liability arose as the individual had a salary increase above the allowable rate in the final year before retirement and in accordance with NHS pension scheme rules the difference in pension liability needs to be funded by the individual’s final employer.

An investigation into the circumstances surrounding this loss, led by our Chief Operating Officer, concluded that there was no evidence of fraud or necessity to take disciplinary or legal action, however it did highlight weakness in our processes which failed to provide adequate oversight of the potential financial risk when staff are seconded with a salary increase above the allowable rate. Interim measures are in place to review all external secondments whilst revisions to policy and governance approval processes are embedded across the organisation to mitigate the risk of future loss. These will ensure the appropriateness of placements, the suitability of candidates, consideration of financial risk and articulates the benefit to the individual and to CQC.

Conclusion

Our internal controls stood up well to our pandemic response. Where required we adapted our approach but ensured that we did not compromise our internal controls.

Our management assurance assessment process remains an essential method for gaining assurance and facilitating improvement in key areas of management responsibility. The process shows we have confidence in our management practice.

Our assessments this year have identified areas we need to improve on and there are plans in place in directorates to make these improvements. To support them, we are ensuring all the directorate assessments are discussed with subject matter experts in CQC, so they can support improvement; and we have created dashboards for directorates so they can easily track their progress against these standards. We will review our progress on our areas that need improving at mid-year 2021-22; and in 2022 do a further assessment of all the areas.

Head of Internal Audit Opinion

In relation to Internal Audit, we have considered and advised on: the annual Internal Audit plan; how well this has supported the Head of Internal Audit’s responsibility to provide her annual opinion on the overall adequacy and effectiveness of the organisation’s risk management, control and governance processes; the results of Internal Audit work and the reports produced; and tracking management response to recommendations made by that work. We acknowledge the emphasis Internal Audit have placed on considering CQC’s Transformation Programme and welcome this focus. The Internal Audit programme has been flexible and targeted to address key areas in the programme as they develop and therefore provide the assurances that we need.

Work in 2020 to 2021 covered a number of areas of governance, including the impact of COVID-19 on CQC, reviews of Programme Management and individual change programmes, and reviews of areas of internal control including regulatory risk management, income and debts, and employment taxes. Twenty-one audit reviews have been completed during 2020 to 2021. Of these, there were 16 reports for which formal ratings were issued. The rating scheme changed between years, but the ratings and comparison to the equivalent from 2019 to 2020 were: three were rated high risk (2019/2020: one limited assurance), nine were rated medium risk (2019/2020: 13 moderate assurance), and four were rated low risk (2019 to 2020: none substantial assurance). One report has been carried over and will be finalised as part of the 2021 to 2022 internal audit programme. The three high risk reports related to CQC’s handling of whistleblowing information (for which management action was in progress at the time), investment appraisal and benefits management and initial planning for the Regulatory Platform programme. All recommendations have been discussed with management and action plans agreed. Generally, progress continues to be made and lessons learned across the organisation.

My opinion is as follows:

Generally satisfactory with some improvements required*.

Governance, risk management and control in relation to business-critical areas is generally satisfactory. However, there are some areas of weakness and/or non-compliance in the framework of governance, risk management and control which potentially put the achievement of objectives at risk. Some improvements are required in those areas to enhance the adequacy and/or effectiveness of the framework of governance, risk management and control.

*Note: the above conclusion, while using a different rating scheme, is consistent with the prior year conclusion, being the second level on a scale of four.

Basis of opinion

My opinion is based on:

- All audits undertaken during the year.

- Results of our follow up of the implementation of agreed actions by management.

- The breadth of the programme, which has incorporated reviews of key transformation programmes including IT projects, work that is underway to develop the new future operating model and the area of provider risk assessment and response (including inspection framework). It has also considered a number of core processes and other functions including Market Oversight and the National Guardian’s Freedom to Speak Up arrangements in arms length bodies.

- The overall commitment of resource to internal audit has been aligned to the agreed budget, but no other limitations have been placed on the scope or resources of internal audit.

- Internal audit continues to receive the support of management and staff, with there being a willingness to accept recommendations and take action to realise improvements where such opportunities are identified. No significant recommendations have not been accepted by management.

We would like to take this opportunity to thank CQC’s staff, for their cooperation and assistance provided during the year.

Scope of report

This report outlines the internal audit work we have carried out for the year ended 31 March 2021.

Purpose of the annual opinion

The Public Sector Internal Audit Standards require the Head of Internal Audit to provide an annual opinion, based upon and limited to the work performed, on the overall adequacy and effectiveness of the organisation’s framework of governance, risk management and control (that is, the organisation’s system of internal control). This is achieved through a risk-based plan of work, agreed with management and approved by the Audit and Corporate Governance Committee (ACGC), which should provide a reasonable level of assurance, subject to the inherent limitations. The opinion does not imply that Internal Audit has reviewed all risks relating to the organisation.

We are satisfied that sufficient internal audit work has been undertaken to allow an opinion to be given as to the adequacy and effectiveness of governance, risk management and control. In giving this opinion, it should be noted that assurance can never be absolute. The most that the internal audit service can provide is reasonable assurance that there are no major weaknesses in the system of internal control.

Compliance with standards

We have a firm wide internal audit methodology which is aligned to the Institute of Internal Auditors International Standards for the Professional Practice of Internal Auditing and public sector internal audit standards.

Key factors

The key factors that contributed to our opinion are summarised as follows:

Governance and risk management

The key element of our governance work in 2020 was to review CQC’s initial response to the COVID-19 pandemic. We also considered how well management had and was responding to the new and changing risks as a result of the pandemic.

Our review of CQC’s initial response showed much good practice. Crisis response and business continuity plans had been in place prior to the pandemic, a clear command structure for crisis management was initiated, and there was early recognition that an independent perspective on plans would be helpful and external assurance was obtained. As part of managing risks, a decision was quickly made to move entirely to home working and to adopt a new, temporary provider assessment framework which lightened the load of inspection on providers and minimised the need to ‘cross the threshold’. Management determined minimum staffing levels to support critical activities, assessed the supplier contract portfolio, and obtained updated continuity and recovery plans and readiness statements where required. A number of fast track procurements were completed, for example to secure stocks of personal protective equipment (PPE).

Our review complimented a wider management exercise designed to ensure any learning from the response was captured. We identified a number of actions designed to assist continuity and resilience planning, and a further number related to the programmes established to return CQC to future normal working. Management had redesigned the controls self-assessment framework. We found strong engagement from staff and an improved focus on evidence, with no concerns arising from our review of a sample of forms prepared by directorates /departments. CQC continues to have a clear focus on the management of risk, particularly the more significant risks via ACGC and Board. The ACGC sub-committee for Transformation received our reports on reviews of transformation programmes and we believe provides a valuable forum to gather assurance and provide challenge over the transformation programme.

Internal control

Of the reviews that we completed during the year, each has considered aspects of internal control. A number of our recommendations related to ongoing transformation programmes, which we have commented on separately below. Our high risk, non-transformation and change findings concerned: a need to enhance the governance for preparation of business cases and completion of business case templates; and assurance over the handling of whistleblowing information, as management had undertaken an extensive review of how information had been handled on cases during the COVID-19 crisis period and implemented actions, but there remained a need to embed these.

Transformation and change programmes

Our updated Programme Governance Baseline Assessment and work on individual programmes evidenced improving programme management and delivery capabilities. In particular, our reviews of the governance of the Digital Foundations Programme and subsequent readiness assessment identified a number of elements of good practice in that programme, which has now delivered new IT infrastructure. Management implemented a new benefits management framework, but a theme from our reviews of Programme Governance, Investment Appraisal and the Registration Programme was the need to fully embed this to achieve a greater focus on benefits, benefits management and benefits realisation. A full re-evaluation of benefits has recently been completed to provide the baseline for future monitoring. Other areas highlighted by our work included defining a clear plan for the future of the Registration Programme, which was subsequently absorbed into Regulatory Platform and elements into business operations, and in the Regulatory Platform programme a need to formalise engagement with the business and approaches to managing plans and delivering quality.

Jane Forbes

Head of Internal Audit

Accounting Officer's conclusion

The COVID-19 pandemic has dominated the year with the whole organisation working from home, or in the field, and a number of fundamental shifts in the way we discharged our regulatory responsibilities.

A significant element of our internal auditor’s work focused on our response to the pandemic. Many elements of good practice were found and the recommendations and suggestions have assisted our learning from the crisis response and will benefit future business continuity and business planning. Our learning here, and from the past five years, has informed our new strategy from 2021 which was published in May 2021 and sets out our ambitions under the themes of: people and communities; smarter regulation; safety through learning; and accelerating improvement.

Delivery of our transformation programme has continued throughout the year and work is focused around: our regulatory framework; regulatory services; and our organisational design and development. The internal audit programme looked at key transformation programmes including IT projects, work to develop the new future operating model and provider risk assessment and response. Again, much good practice was identified and we have worked to implement the agreed actions flowing out of these audit report.

We continue to ensure that robust mechanisms are in place to assess risk and compliance, with regular review at the Board and the ACGC.

The Head of Internal Audit has provided an annual opinion providing satisfactory assurance that there are adequate and effective systems of governance, risk management and control.

I agree with their conclusion.

CQC has complied with HM Treasury’s Corporate Governance in Central Government Department’s Code of Good Practice to the extent that they apply to a non-departmental public body.

I conclude that CQC’s governance and assurance processes have supported me in discharging my role as Accounting Officer. I am not aware of any significant internal control problems in 2020 to 2021. Work will continue in 2020 to 2022 to maintain and strengthen the assurance and overall internal control environment in CQC.

Remuneration and people report

Remuneration report

This section provides details of the remuneration (including any non-cash remuneration) and pension interests of Board members, independent members, the Chief Executive and the ET. The content of the tables and fair pay disclosures are subject to audit.

Remuneration of the Chair and non-executive Board members

Non-executive Board members’ remuneration is determined by the DHSC based on a commitment of two to three days per month.

There are no provisions in place to compensate for the early termination or the payment of a bonus in respect of non-executive Board members.

The Chairman and non-executive Board members are also reimbursed for expenses incurred in the fulfilment of their commitments to CQC. Expenses are grossed up to account for the tax and national insurance due, in accordance with HMRC rules.

Non-executive Board members are not eligible for pension contributions or performance-related pay as a result of their employment with CQC.

Chairman and non-executive Board members’ emoluments (subject to audit)

ARA 2020 to 2021: Chairman and non executive Board members emoluments (subject to audit)

Payments to independent members of ACGC (subject to audit)

Independent members of ACGC are paid fees on a per meeting basis and are also reimbursed for expenses incurred in fulfilling their commitments to CQC.

ARA 2020 to 2021: Payments to independent members of ACGC (subject to audit)

Remuneration and pension benefits of the Executive Team

Remuneration

The Chief Executive and members of the ET are employed on CQC’s terms and conditions under permanent employment contracts.

The remuneration of the Chief Executive and the ET members was set by the remuneration committee and is reviewed annually within the scope of the national pay and grading scale applicable to ALBs.

For the Chief Executive and ET, early termination, other than for gross misconduct (in which no termination payments are made), is covered by their contractual entitlement under CQC’s redundancy policy (or their previous legacy Commission’s redundancy policy if they transferred). Contracts of ET members include three months’ notice and termination payments are only made in appropriate circumstances. They may also be able to access the NHS pension scheme arrangements for early retirement, depending on age and scheme membership. Any amounts disclosed as compensation for loss of office are also included in our people report.

Salary includes gross salary, overtime, recruitment and retention allowances and any other allowance to the extent that it is subject to UK taxation. It does not include employer pension contributions and the cash equivalent transfer value of pensions.

No performance pay, bonus or compensation for loss of office were paid to any member of the ET, or former members, during 2020 to 2021.

Remuneration of the ET (subject to audit)

ARA 2020 to 2021: Renumeration of the ET (subject to audit)

Pension benefits

Pension benefits were provided through the NHS pension scheme for members who chose to contribute. Pension benefits at 31 March 2021 may include amounts transferred from previous employment, while the real increase reflects only the proportion of the time in post if the employee was not employed by CQC for the whole year.

Pension benefits of the Chief Executive and ET (subject to audit)

ARA 2020 to 2021: Pension benefits of the Chief Executive and ET (subject to audit)

Cash equivalent transfer values

A cash equivalent transfer value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity at CQC to which the disclosures apply.

The CETV figures include the value of any pension benefit in another scheme or arrangement that the individual has transferred to the NHS pension scheme. They also include any additional pension benefit accrued to the member as a result of them purchasing additional years of pension service in the scheme at their own cost. CETVs are calculated within the guidelines and framework prescribed by the Institute and Faculty of Actuaries and do not take account of any potential reduction to benefits resulting from Lifetime Allowance Tax that may be due when pension benefits are drawn.

Real increase in CETV

This reflects the increase in CETV effectively funded by the employer. It does not include the increase in accrued pension due to inflation or contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement).

Fair pay (subject to audit)

Reporting bodies are required to disclose the relationship between the remuneration of the highest paid director in their organisation and the median remuneration of the organisation’s employees.

The annualised banded remuneration of the highest paid director in CQC during 2020 to 2021 was £195-200k (2019 to 2020: £205-210k). This was 4.8 times (2019 to 2020: 5.2) the median remuneration of CQC’s employees, which was £40,805 (2019 to 2020: £39,810). This ratio has reduced due to the taxable benefits in kind of the highest paid director being lower during 2020 to 2021.

In 2020/21, two employees (2019 to 2020: none) have annualised equivalent remuneration in excess of the highest paid director. Each of these individuals were specialist contractors to support our change programme. The calculation is based on the full-time equivalent employees of the reporting entity at the reporting period end date, on an annualised basis. Remuneration ranged from £15-20k to £215-220k (2019 to 2020: £15-20k to £205-210k).

Total remuneration includes salary, non-consolidated performance-related pay, benefits in kind but not severance payments. It does not include employer pension contributions and the cash equivalent transfer value of pensions.

[Note: the prior year comparative relating to the number of employees with annualised equivalent remuneration in excess of the highest paid director has been restated.]

People report

1. Employee costs and numbers (subject to audit)

1.1 Employee costs

ARA 2020 to 2021: 1.1 Employee costs

Other employee costs consist of:

| 2020 to 2021 total £000 | 2019 to 2020 total £000 | |

|---|---|---|

| Second Opinion Appointed Doctors | 3,504 | 3,603 |

| Agency | 3,020 | 1,459 |

| Inward secondments from other organisations | 549 | 729 |

| Bank inspectors and specialist advisors | 538 | 4,425 |

| Commissioners | 51 | 46 |

| Total | 7,662 | 10,262 |

1.2 Average number of employees

The average number of whole-time equivalent employees during the year was:

| 2020 to 2021 number | Restated 2019 to 2020 number | |

|---|---|---|

| Directly employed | 3,022 | 3,109 |

| Other | 11 | 13 |

| Employees engaged on capital projects | 30 | 18 |

| Total | 3,063 | 3,140 |

[Note: For 2019 to 2020 number, the prior year comparative relating to the number of employees with annualised equivalent remuneration in excess of the highest paid director has been restated.]

‘Other’ includes agency staff and inward secondments from other organisations. It does not include bank inspectors, specialist advisors, commissioners or Second Opinion Appointed Doctors that are paid per session.

The actual number of directly employed whole-time equivalents as at 31 March 2021 was 3,056 (31 March 2020: 3,102).

Staff turnover during 2020 to 2021 was 7.9% (2019/20: 10.4%).

1.3 Pension information

The principal pension scheme for CQC employees is the NHS Pension Scheme and is used for automatic enrolment. Those not eligible to join the NHS Pension Scheme are enrolled with the National Employment Savings Trust (NEST). Due to legacy arrangements CQC also have active members in 14 local government pension schemes (LGPS).

Automatic enrolment applies to all employees under a standard contract of employment with CQC as well as Mental Health Act Reviewers, Second Opinion Appointed Doctors (SOADs) and all employees on casual or zero-hour contracts. All employees retain the option to opt out at any time.

NHS Pension Scheme

Past and present employees are covered by the provisions of the two NHS Pension Schemes. See details of the benefits payable and rules of the Schemes on the NHS Pensions website. Both are unfunded defined benefit schemes that cover NHS employers, GP practices and other bodies, allowed under the direction of the Secretary of State for Health and Social Care in England and Wales. They are not designed to be run in a way that would enable NHS bodies to identify their share of the underlying scheme assets and liabilities. Therefore, each scheme is accounted for as if it were a defined contribution scheme: the cost to the NHS body of participating in each scheme is taken as equal to the contributions payable to that scheme for the accounting period.

In order that the defined benefit obligations recognised in the financial statements do not differ materially from those that would be determined at the reporting date by a formal actuarial valuation, the FReM requires that “the period between formal valuations shall be four years, with approximate assessments in intervening years”. An outline of these follows:

a) Accounting valuation

A valuation of scheme liability is carried out annually by the scheme actuary (currently the Government Actuary’s Department) as at the end of the reporting period. This utilises an actuarial assessment for the previous accounting period in conjunction with updated membership and financial data for the current reporting period and is accepted as providing suitably robust figures for financial reporting purposes. The valuation of the scheme liability as at 31 March 2021 is based on valuation data as at 31 March 2020, updated to 31 March 2021 with summary global member and accounting data. In undertaking this actuarial assessment, the methodology prescribed in IAS 19, relevant FReM interpretations, and the discount rate prescribed by HM Treasury have also been used.

The latest assessment of the liabilities of the scheme is contained in the report of the scheme actuary, which forms part of the annual NHS Pension Scheme Accounts. These accounts can be viewed on the NHS Pensions website and are published annually. Copies can also be obtained from The Stationery Office.

b) Full actuarial (funding) valuation

The purpose of this valuation is to assess the level of liability in respect of the benefits due under the schemes (taking into account recent demographic experience), and to recommend contribution rates payable by employees and employers.

The latest actuarial valuation undertaken for the NHS Pension Scheme was completed as at 31 March 2016. The results of this valuation set the employer contribution rate payable from April 2019 to 20.6% of pensionable pay. The 2016 funding valuation was also expected to test the cost of the Scheme relative to the employer cost cap that was set following the 2012 valuation. In January 2019, the Government announced a pause to the cost control element of the 2016 valuations, due to the uncertainty around member benefits caused by the discrimination ruling relating to the McCloud case.

The Government subsequently announced in July 2020 that the pause had been lifted, and so the cost control element of the 2016 valuations could be completed. The Government has set out that the costs of remedy of the discrimination will be included in this process. HMT valuation directions will set out the technical detail of how the costs of remedy will be included in the valuation process. The Government has also confirmed that the Government Actuary is reviewing the cost control mechanism (as was originally announced in 2018). The review will assess whether the cost control mechanism is working in line with original government objectives and reported to Government in April 2021. The findings of this review will not impact the 2016 valuations, with the aim for any changes to the cost cap mechanism to be made in time for the completion of the 2020 actuarial valuations.

Employer contributions for employees in the NHS Pension Scheme was 20.68% of each active member’s pensionable pay during 2020 to 2021 (2019 to 2020: 20.68%). This rate includes an amount charged to cover the cost of scheme administration equating to 0.08% of pensionable pay.

For early retirements, other than those due to ill health, the additional pension liabilities are not funded by the scheme. The full amount of the liability for the additional costs charged to expenditure was £nil (2019 to 2020: £nil).

Local government pension schemes (LGPS)

LGPS are primarily open to employees in local government, but also to those who work in associated organisations. The scheme is managed locally and invests pension funds within the framework of regulations provided by government.

CQC inherited active membership in 17 local government schemes as part of legacy arrangements of predecessor organisations on formation. CQC membership in three of the original schemes have now ceased and at 31 March 2021 active membership was held in 14 schemes. On 31 January 2021 active membership ended in the Dorset Pension Fund resulting in a cessation charge totalling £2,322k being payable which was equal to the actuarial assessed pension deficit on that date.

All remaining schemes are closed to new CQC employees. Under the projected unit method, the current service cost will increase as the members of the scheme approach retirement.

Employer contributions for 2020 to 2021, based on a percentage of payroll costs only, were £2,652k (2019 to 2020: £2,869k), at rates ranging between 0% and 49.2% (2019 to 2020: 0% and 41.6%). Employer contributions relating to the largest scheme, Teesside Pension Fund, were £2,403k (2019 to 2020: £2,519k) at a rate of 17.9% (2019 to 2020: 17.9%).

During 2020/21, indexed cash sums were levied in addition to a percentage of payroll costs as part of a strategy to reduce fund deficits. In total, £1,479k (2019 to 2020: £1,936k) was paid to 9 of the 15 remaining pension funds, including Dorset Pension Fund, with amounts ranging from £6k to £515k (2019 to 2020: £7 to £515k). No additional sums were paid in respect of the largest scheme, Teesside Pension Fund.

National Employment Savings Trust (NEST)

The NEST is a qualifying pension scheme established by law to support automatic enrolment.

Employer contributions based on a percentage of payroll costs totalled £68k for 2020 to 2021 (2019 to 2020: £71k) at a rate of 3% (2019 to 2020: 3%).

2. Exit packages (subject to audit)

| Exit package cost band | Compulsory redundancies (Number) | Compulsory redundancies (£) | Other departures (Number) | Other departures (£) |

|---|---|---|---|---|

| Less than £10,000 | 3 | 13,837 | - | - |

| £10,000 – £25,000 | 4 | 62,782 | - | - |

| £25,001 – £50,000 | 2 | 54,600 | - | - |

| £50,001 – £100,000 | - | - | - | - |

| £100,001 to £150,000 | - | - | - | - |

| £150,001 – £200,000 | 1 | 166,468 | - | - |

| More than £200,000 | - | - | - | - |

| Total | 10 | 297,687 | - | - |

| Exit package cost band | 2020 to 2021 total exit packages (number) | 2020 to 2021 total exit packages (£) | 2019 to 2020 total exit packages (number) | 2019 to 2020 total exit packages (£) |

|---|---|---|---|---|

| Less than £10,000 | 3 | 13,837 | 3 | 4,070 |

| £10,000 – £25,000 | 4 | 62,782 | 4 | 63,858 |

| £25,001 – £50,000 | 2 | 54,600 | 2 | 67,841 |

| £50,001 – £100,000 | - | - | 3 | 167,623 |

| £100,001 to £150,000 | - | - | - | - |

| £150,001 – £200,000 | 1 | 166,468 | - | - |

| More than £200,000 | - | - | - | - |

| Total | 10 | 297,687 | 12 | 303,392 |

Redundancy and other departure costs were paid in accordance with CQC’s terms and conditions approved by DHSC’s Governance and Assurance Committee. Exit costs are accounted for in full in the year of departure. Where early retirements have been agreed, the additional costs are met by CQC and not by the individual pension scheme. Ill-health retirement costs are met by the pension scheme and are not included in the table.

None of the exit packages relate to individuals named in the Remuneration report (2019/20: none).

| 2020 to 2021 agreements number | 2020 to 2021 total value of agreements £000 | 2019 to 2020 agreements number | 2019 to 2020 total value of agreements £000 | |

|---|---|---|---|---|

| Voluntary redundancies including early retirement contractual costs | - | - | - | - |

| Mutually agreed resignations (MARS) contractual costs | - | - | - | - |

| Early retirements in the efficiency of service contractual costs | - | - | - | - |

| Contractual payments in lieu of notice | - | - | - | - |

| Exit payments following employment tribunals or court orders | - | - | - | - |

| Non-contractual payments requiring HM Treasury approval | - | - | 2 | 32 |

| Total | - | - | 2 | 32 |

No non-contractual payments (£nil) were made to individuals where the payment value was more than 12 months of their annual salary.

3. Off-payroll engagements

As part of the Review of the tax arrangements of public sector appointees we are required to publish (via the Department of Health and Social Care) information about the number of off-payroll engagements that are in place where individual costs exceed £245 per day.

| Number of arrangements that have existed, at the time of reporting: | Number |

|---|---|

| for less than one year | 10 |

| for between one and two years | 1 |

| for between two and three years | 3 |

| for between three and four years | - |

| for four or more years | - |

| Total | 14 |

All off-payroll appointment engaged at any point between 1 April 2020 and 31 March 2021 that were for more than £245 per day.

There were 37 temporary off-payroll workers engaged between 1 April 2020 and 31 March 2021, of which:

- 3 were not subject to off-payroll legislation

- 34 were subject to off-payroll legislation and determined as in-scope of IR35

Of the temporary off-payroll workers engaged between 1 April 2020 and 31 March 2021:

- None were engaged directly (via a Personal Service Company contracted to CQC) and are on our payroll

- 14 were reassessed for consistency or assurance purposes during the year

- None saw a change to IR35 status following the consistency review.

Number of off-payroll engagement relating to Board members and senior officials with significant financial responsibilities who held post between 1 April 2020 and 31 March 2021.

- There were no off-payroll engagements of Board members and/or senior officials with significant financial responsibility during the year.

- There were 18 individuals on payroll and off-payroll that have been deemed Board members, and/or senior officials with significant financial responsibilities during the financial year.

We are committed to building in-house capacity, but it is recognised that, with a significant element of our activity being project based, with peaks and troughs in requirements, making the best use of the temporary labour market is essential. Many of the workstreams within our change programme require specialist input on a temporary basis and it is not always cost-effective to permanently recruit such skills.

All existing engagements at 31 March 2021 have received approval from DHSC. We continue to improve our assurance processes so that we categorise all engagements in line with best practice and to ensure that we are compliant with HMRC’s off-payroll working rules which changed on 6 April 2021.

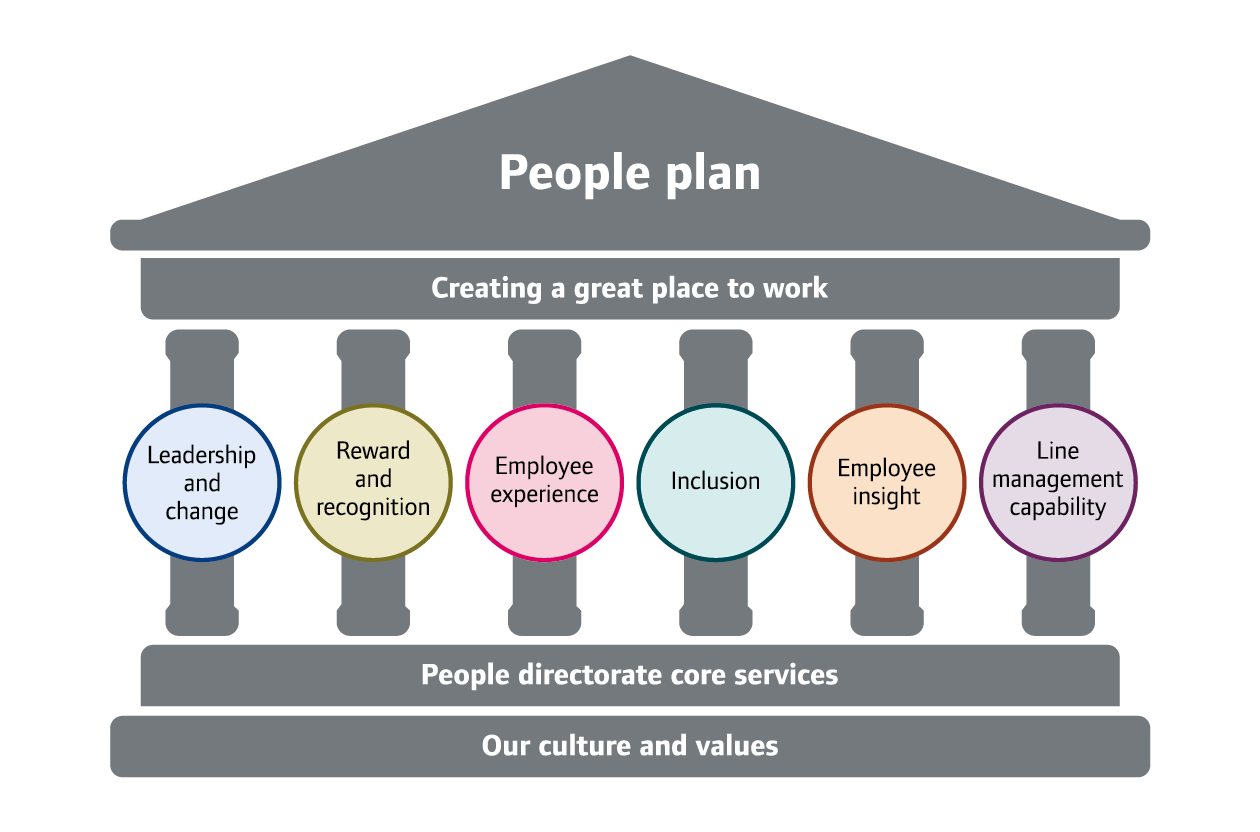

4. People plan

We are ambitious to build a fully inclusive organisation where we attract, develop and retain capable people, delivering our organisational purpose, and where all our people feel engaged and demonstrate our values every day. To achieve this, our People Plan is built on six key pillars – these are our key people priorities to enable the organisation’s future delivery. The People Plan is underpinned by individual delivery plans for the respective workstreams and a high-level timeline to track progress.

The People Plan is built on six key pillars:

- leadership and change

- reward and recognition

- employee experience

- inclusion

- employee insights

- line management capability.

The plan is underpinned by the Culture and Values of the organisation.

5. People policies and engagement

Our people are involved in a wide range of consultation and engagement on policies on areas such as organisational change and future strategic direction, to make sure all views are heard.

We recognise UNISON, the Royal College of Nurses, the Public and Commercial Services Union (PCS), Unite and Prospect for the purposes of collective bargaining and consultation. Representatives from across the unions make up our Joint Negotiation and Consultation Committee (JNCC). CQC’s management collaborates with the JNCC on a range of issues affecting employees.

We also have a forum that represents the voices of all people in the organisation (the staff forum). Representatives come together to update the management team on the views of colleagues.

We regularly review our people management policies to make sure they meet best practice guidelines, reflect changes to the culture of CQC and enable us to support all colleagues to develop. Through our Equality Impact Assessment framework, we ensure all our policies are accessible and that they promote inclusion for everyone. In our reviews we always consult with representatives from the People directorate, the unions, the staff forum and the equality networks. We currently have five fully supported staff equality networks at CQC. Our networks are key in supporting with the delivery of our Diversity and Inclusion strategy priorities and contribute effectively to organisational improvement. Our network chairs have a seat at Board meetings and are given protected time for their Chair and Vice Chair roles and network activities.

All our People Management policies are legally compliant and follow the Advisory, Conciliation and Arbitration Service (ACAS) code of practice and best practice. We are currently undertaking a review of our People Management policies to check against best practice for Equality Act 2010 compliance. Supporting all our employees is at the heart of our organisational approach, including those with a disability alongside other colleagues with protected characteristics. More specifically, Managing Sickness Absence, Critical Illness, and our Reasonable Adjustments policies all make reference to the support available to employees with a disability.

Our collective capacity to achieve our purpose is enabled through a healthy and engaged workforce and as a regulator of health and social care it’s important that we exemplify good practice. Our People Plan enables a clear focus on activity that enables this, including Diversity and Inclusion and Wellbeing strategies.

Throughout the pandemic we have engaged a wide network of colleagues regularly on Diversity and Inclusion and Wellbeing activity. We measure ourselves against best practice through MIND’s workplace wellbeing index, Stonewall and other benchmarking groups. We have also signed up to the MH at Work commitment and are using these standards to inform our approach.

We have appointed our own CQC Guardians for the Freedom to Speak Up, who are supported by a team of Freedom to Speak Up ambassadors drawn from all parts of CQC. This assists us in our commitment to have an open culture where staff can raise any concerns they have. This help ranges from just listening, to signposting, to investigation of whistleblowing concerns. The Guardians report to the board twice yearly and their role includes identifying themes and trends across the organisation.

6. Equality, diversity and inclusion

Our colleagues work in a variety of roles across the organisation including in inspection teams, in our customer contact centre and in corporate or intelligence roles to support our regulatory activity. Having highly dispersed teams creates its own challenges and complexities in ensuring our diversity and inclusion ambitions reach all our people and everyone feels a sense of belonging to the organisation.

We are fully committed to ensuring we meet our legal responsibilities under the Equality Act 2010. Our approach and commitment to diversity and inclusion includes and goes beyond our legal responsibilities.

‘Our inclusive future’ is CQC’s three-year strategy, launched in 2020, focusing on diversity and inclusion for our colleagues and within our teams. The strategy sets out our ambition to achieve our vision of being a truly inclusive organisation where all our people are valued and make a difference.

We have four overarching strategic priorities to position diversity and inclusion at the heart of everything we do:

- inclusive leadership and accountability

- inclusive culture

- inclusive engagement

- inclusive policies and practices.

We believe this approach ensures that actions are not just delivered but embedded in our day-to-day work.

Through setting our priorities in this strategy, we will inspire and encourage colleagues to view their work through an inclusion lens and create safe environments to explore diverse ways of thinking, leading to an open, fair and compassionate environment.

6.1 Equality profiles

The table and graphs below show CQC equality profiles as at 31 March 2021:

| Board members and Executive Directors | Directors | Other employees | Total employees | |

|---|---|---|---|---|

| Male | 9 | 8 | 947 | 964 |

| Female | 4 | 19 | 2,189 | 2,212 |

| Board members and Executive Directors | Directors | Other employees | Total employees | |

|---|---|---|---|---|

| Male | 9 | 7 | 961 | 977 |

| Female | 4 | 19 | 2,234 | 2,257 |

Ethnicity

| Ethnicity | 31 March 2021 | 31 March 2020 |

|---|---|---|

| Black and minority ethnic | 14% | 13% |

| White | 77% | 78% |

| Not stated | 9% | 9% |

Disability

| Disability | 31 March 2021 | 31 March 2020 |

|---|---|---|

| No | 86% | 86% |

| Yes | 8% | 8% |

| Not declared | 6% | 6% |

Sexual orientation

| Sexual orientation | 31 March 2021 | 31 March 2020 |

|---|---|---|

| Heterosexual | 78% | 78% |

| LGBTQ+ | 6% | 6% |

| Not stated | 16% | 16% |

Age band

| Age band | 31 March 2021 | 31 March 2020 |

|---|---|---|

| 21-30 | 8% | 8% |

| 31-40 | 29% | 29% |

| 41-50 | 27% | 27% |

| 51-60 | 28% | 28% |

| 60+ | 7% | 9% |

Religious beliefs

| Religious beliefs | 31 March 2021 | 31 March 2020 |

|---|---|---|

| Atheism | 11% | 10% |

| Buddhism | 0% | 0% |

| Christianity | 42% | 43% |

| Hinduism | 1% | 1% |

| Islam | 3% | 2% |

| Judaism | 0% | 0% |

| Not stated | 37% | 37% |

| Other | 5% | 4% |

| Sikhism | 1% | 1% |

6.2 Gender pay gap

The gender pay gap gives a snapshot of the gender balance in an organisation. It measures the difference between the average earnings of all male and female employees, irrespective of their role or seniority.

As at 31 March 2021 the gender split in CQC was 69.6% female employees to 30.4% male employees and this was closely replicated across the quartile data (31 March 2020: female 69.5%, male 30.5%).

The data shows that there is no gender pay gap in median pay at CQC, as employees are paid within salary bands and the rate of pay is virtually the same across all quartiles. Although the pay gap has increased slightly in mean pay, our pay gap continues to be small and we therefore plan to monitor it over the coming months and put in any measures we need to if we do not see an improvement.

No data is included in CQC’s gender pay gap reporting for bonuses as CQC does not pay performance-related bonuses.

| Pay gap type | |

|---|---|

| Mean pay gap, ordinary pay | 1.7% |

| Median pay gap, ordinary pay | 0% |

| Mean pay gap, bonus pay in the 12 months ending 31 March 2021 | n/a |

| Median pay gap, bonus pay in the 12 months to 31 March 2021 | n/a |

| Quartile | Male | Female |

|---|---|---|

| First (lower) quartile | 35.01% | 64.99% |

| Second quartile | 26.55% | 73.45% |

| Third quartile | 26.50% | 73.50% |

| Fourth (upper) quartile | 34.49% | 65.51% |

7. Trade union facility time

We work in partnership with trades union representatives on all matters affecting our people. Regular Joint Negotiation and Consultation Committee (JNCC) meetings are held every quarter comprising representatives from our People directorate, senior leadership team and trade union representatives from CQC alongside external national union officers. This forum allows discussion, consultation and negotiation on employment-related matters.

Our people are permitted to engage in appropriate trade union activities. Details are below:

7.1 Relevant Trade Union Officials

| Relevant union officials | |

|---|---|

| Number of employees who were relevant union officials during the relevant period | 30 |

| Full-time equivalent employee number | 29.8 |

7.2 Percentage of time spent on facility time

| Percentage of time | Number of employees |

|---|---|

| 0% | - |

| 1–50% | 30 |

| 51–99% | - |

| 100% | - |

7.3 Percentage of pay bill spent on facility time

| Percentage of pay bill spent on facility time | |

|---|---|

| Total cost of facility time | £38k |

| Total pay bill | £175,982k |

| Percentage of the total pay bill spent on facility time, calculated as: (total cost of facility time ÷ total pay bill) x 100 | 0.02% |

7.4 Paid trade union activities

Time spent on paid trade union activities as a percentage of total paid facility time hours was 15.98%.

This is calculated as:

(Total hours spent on paid trade union activities by relevant union officials during the relevant period ÷ total paid facility time hours) x 100

8. Sickness absence

During 2020 to 2021, the average number of long-term days of sickness per absent employee was 15 (2019 to 2020: 17 days) and the average number of short-term days of sickness was three (2019 to 2020: 4 days).

9. Health and safety

In March 2020 we started to implement our response to COVID-19 to support the safe operation of the business and staff and to allow us to respond quickly and effectively to new and emerging risks.

Temporary home working

Almost 1,000 office-based staff were assisted to work at home and were provided with workstation furniture, chairs and peripheral IT equipment to do this safely. Colleagues were required to complete a Display Screen Equipment Assessment for their new workstation and support and guidance was provided to assist them. Those colleagues who have medical conditions that require reasonable adjustments were provided with the appropriate equipment and support.

These changes were made very early on in the pandemic and initially relied on rented furniture. This was subsequently swapped out using surplus office furniture resulting from the London office move and other changes.

Personal protective equipment

A comprehensive set of Personal Protective Equipment was provided to all inspectors. This was supported with updated infection control and protection procedures; training and guidance documents were developed to support this. Colleagues were also issued with scrubs to wear on inspections.

Risk assessments

An Inspection risk assessment was developed to support the Emergency Support Framework to ensure that inspectors were fully assessed and safe. The assessment continues to be updated to reflect new ways of working.

An Individual risk assessment was developed in response to the ‘Disparities in the risks and outcomes of COVID-19' report released by Public Health England which detailed the health inequalities of COVID-19 for specific groups of the population. Each colleague was asked to complete this assessment to determine how best CQC could support them during the pandemic.

Re-opening offices

All CQC offices closed at the outset of the pandemic but were reviewed and provided with full COVID secure measures to allow a small number of essential colleagues to work safely. Work is currently ongoing to develop risk assessments and safe working procedures with a view to a wider opening of CQC offices when Government guidelines allow this.

Testing for inspectors

Weekly Polymerase Chain Reaction (PCR) testing was introduced for colleagues crossing provider thresholds. Supporting guidance and training materials were produced to support colleagues. We introduced Lateral Flow Tests (LFT) to enable everyone crossing a threshold in a care setting to test themselves on the morning of their visit. The LFT testing regime will provide further assurance to colleagues and providers that they are not COVID-19 positive prior to entering the care setting.

10. Expenditure on consultancy

Total spend on consultancy services, as defined by HM Treasury, during 2020 to 2021 was £659k (2019 to 2020: £66k) and was subject to approval from DHSC in line with our delegations. The majority of this spend was connected to our change programme and laying the foundations for our new Regulatory Platform.

Parliamentary accountability and audit report

The content of notes 1 to 3 are subject to audit.

1. Regularity of expenditure

Losses and special payments are items that Parliament would not have contemplated when it agreed funding or passed legislation. By their nature, they are items that ideally should not arise and should only be accepted if there is no feasible alternative. They are therefore subject to special control procedures compared with the generality of payments.

1.1 Losses

| 2020 to 2021 | 2019 to 2020 | |

|---|---|---|

| Total number of losses | 563 | 675 |

| Total value of losses (£000) | 1,579 | 1,152 |

CQC incurred two losses exceeding £300k during the year (2019 to 2020: one case totalling £351k). Approval has been obtained from DHSC, in accordance with our delegated authority, to settle both cases. Liabilities of £701k arose from a HMRC compliance check covering a period of four years and includes the social security costs relating to the benefits arising from those deemed to have a dual workplace. An NHS pension scheme final pay control charge of £531k was also incurred following the immediate retirement of an individual upon completion of a secondment to an external body (see page 34 of the Governance Statement for further details) which we have also brought to HM Treasury’s (HMT) attention in accordance with Managing Public Money.

1.2 Special payments

| 2020 to 2021 | 2019 to 2020 | |

|---|---|---|

| Total number of special payments | 1 | 5 |

| Total value of special payments (£000) | 1 | 32 |

1.3 Gifts

During 2020 to 2021 CQC made no gifts or donations (2019 to 2020: none).

2. Remote contingent liabilities

There were no remote contingent liabilities as at 31 March 2021 (31 March 2020: none).

3. Fees and charges

Fees are charged in accordance with section 85 of the Health and Social Care Act 2008 to cover the cost of our regulatory functions. This includes initial registration, changes to registration and our activities associated with monitoring, inspection and rating registered providers. Other existing responsibilities, such as our work under the Mental Health Act, are funded by grant-in-aid from DHSC.

Registered providers are charged an annual fee based on the type and scale of services provided. The current fees scheme, effective from 1 April 2019, sets fees at a level to recover our chargeable costs in fees as required by HM Treasury policy. See our fees guidance for providers for further details.

The following table provides an analysis of the income and costs associated with our regulatory activities for which a fee is charged, see notes to the financial statements (note 2.3) for further details.

| Income £000 | Full cost £000 | 2020 to 2021 Surplus £000 | Restated 2019 to 2020 Surplus £000 | |

|---|---|---|---|---|

| Regulatory fees for chargeable activities | (205,192) | 196,048 | 9,144 | (5,477) |

[Note: Full chargeable cost of £196,048k in the above table excludes non-cash items totalling £1,867k from the total expenditure relating to chargeable activities presented in note 2.3 in the notes to the Financial Statements. These non-cash items consist of the provision for pension fund deficits £819k, net interest on pension scheme assets and liabilities £1,934k, expected credit loss £259k, provision expenses (£1,208k), finance expenses £7k and apprenticeship training grant expense £56k all of which are covered by non-cash budgets.]

There will always be variation when aligning costs for chargeable activity to our fee income on an annual basis, in 2020/21 this represents a 4% surplus. During 2020/21 the full cost of our chargeable activities is lower than anticipated due to the impact of COVID-19 on our normal operations.

4. Better payment practice code

In accordance with the governments prompt payment policy CQC aims to pay 90% of undisputed and valid invoices within five working days and 100% of all undisputed and valid invoices within 30 days.

| Target | 2020 to 2021 Number | 2020 to 2021 Value | 2019 to 2020 Number | 2019 to 2020 Value | |

|---|---|---|---|---|---|

| Invoices paid within five working days | 90% | 76.6% | 71.5% | 77.1% | 72.7% |

| Invoices paid within 30 days | 100% | 98.4% | 98.1% | 98.1% | 99.3% |

Ian Trenholm

Chief Executive, Care Quality Commission

10 January 2022

Certificate and report of the Comptroller and Auditor General to the Houses of Parliament

Opinion on financial statements

I certify that I have audited the financial statements of the Care Quality Commission for the year ended 31 March 2021 under the Health and Social Care Act 2008. The financial statements comprise the Statements of Comprehensive Net Expenditure, Financial Position, Cash Flows, Changes inTaxpayers’ Equity; and the related notes, including the significant accounting policies. These financial statements have been prepared under the accounting policies set out within them. The financial reporting framework that has been applied in their preparation is applicable law and International Accounting Standards as interpreted by HM Treasury’s Government Financial Reporting Manual.

I have also audited the information in the Accountability Report that is described in that report as having been audited.

In my opinion, the financial statements:

- give a true and fair view of the state of the Care Quality Commission’s affairs as at 31 March 2021 and of the Care Quality Commission’s net expenditure for the year then ended; and

- have been properly prepared in accordance with the Health and Social Care Act 2008 and Secretary of State directions issued thereunder.

Opinion on regularity

In my opinion, in all material respects, the income and expenditure recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions recorded in the financial statements conform to the authorities which govern them.

Basis for opinions

I conducted my audit in accordance with International Standards on Auditing (ISAs) (UK), applicable law and Practice Note 10 ‘Audit of Financial Statements of Public Sector Entities in the United Kingdom’. My responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of my certificate.

Those standards require me and my staff to comply with the Financial Reporting Council’s Revised Ethical Standard 2019. I have also elected to apply the ethical standards relevant to listed entities. I am independent of the Care Quality Commission in accordance with the ethical requirements that are relevant to my audit of the financial statements in the UK. My staff and I have fulfilled our other ethical responsibilities in accordance with these requirements.

I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion.

Conclusions relating to going concern

In auditing the financial statements, I have concluded that the Care Quality Commission’s use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work I have performed, I have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the Care Quality Commission’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

My responsibilities and the responsibilities of the Board and the Accounting Officer with respect to going concern are described in the relevant sections of this certificate.

The going concern basis of accounting for the Care Quality Commission is adopted in consideration of the requirements set out in HM Treasury’s Government Financial Reporting Manual, which require entities to adopt the going concern basis of accounting in the preparation of the financial statements where it is anticipated that the services which they provide will continue into the future.

Other information

The other information comprises information included in the annual report, but does not include the parts of the Accountability Report described in that report as having been audited, the financial statements and my auditor’s certificate thereon. The Board and the Accounting Officer is responsible for the other information. My opinion on the financial statements does not cover the other information and except to the extent otherwise explicitly stated in my certificate, I do not express any form of assurance conclusion thereon. In connection with my audit of the financial statements, my responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or my knowledge obtained in the audit or otherwise appears to be materially misstated. If I identify such material inconsistencies or apparent material misstatements, I am required to determine whether this gives rise to a material misstatement in the financial statements themselves. If, based on the work I have performed, I conclude that there is a material misstatement of this other information, I am required to report that fact. I have nothing to report in this regard.

Opinion on other matters

In my opinion, based on the work undertaken in the course of the audit:

- the parts of the Accountability Report to be audited have been properly prepared in accordance with Secretary of State directions made under the Health and Social Care Act 2008; and

- the information given in the Performance and Accountability Reports for the financial year for which the financial statements are prepared is consistent with the financial statements.

Matters on which I report by exception

In the light of the knowledge and understanding of the Care Quality Commission and its environment obtained in the course of the audit, I have not identified material misstatements in the Performance Report and Accountability Report. I have nothing to report in respect of the following matters which I report to you if, in my opinion:

- adequate accounting records have not been kept or returns adequate for my audit have not been received from branches not visited by my staff; or