Contents

1. Introduction to Market Oversight

- What is Market Oversight?

- How does Market Oversight link with local authority duties?

- Market Oversight statutory framework

- Market Oversight operating model overview

- The Market Oversight team

- How we will handle commercially sensitive information

2. How we deliver the Market Oversight Scheme

- Stage 1 – Entry to the Scheme

- Review of decision to be entered in the Scheme

- Leaving the Scheme

- Stage 2 – Regular/standard monitoring

- Stage 3 – Potential concerns identified, additional provider engagement likely

- Stage 4 – Financial sustainability concerns identified, heightened provider engagement necessary

- Stage 5 – Significant risk to financial sustainability identified

- Independent Business Reviews

- Risk Mitigation Plan

- Interaction between an Independent Business Review and a Risk Mitigation Plan

- Stage 6 – Formal notification of likely business failure and likely service cessation to local authorities

- When will we notify local authorities?

- Whom will we notify?

- How will we notify?

- What will the notification include?

- Who else will we share the fact of notification with?

- What if business failure does not occur?

- When is the local authority’s duty triggered?

- Continuing provider obligations

- Roles and responsibilities in the event of business failure

- Consistent and timely messaging

- Ongoing monitoring of provider care quality

- Registration

- Provider obligations and responsibilities

- Responding to uncooperative providers

- Working with other regulators to reduce the regulatory burden on providers

Appendix A: Glossary of terms

Appendix B: Sections 53 to 57 of the Care Act 2014; Sections 64 and 65 of the Health and Social Care Act 2008; and the Care and Support Regulations in relation to Market Oversight

Appendix C: Arrangements for 'passporting' providers into the Market Oversight Scheme who do not meet the entry criteria set out in Regulations

Appendix D: Financial and quality indicators

Appendix E: Example risk scenarios and CQC’s likely response

Appendix F: Information undertakings

Appendix G: Key changes to 2015 guidance

Update to 2015 guidance

The updates to the 2015 edition of the guidance as well as the update made in May 2022 are shown in Appendix G at the end of this document.

Foreward

The Community Care Act reforms in 1991 shifted the provision of social care from the public sector to a mixed market. This means that when providers exit the market and close services, managing these exits well is even more important as disruption to care services can cause severe distress and pose real risks to people’s health and wellbeing. It can also cause a lot of stress and anxiety for families as well as the carers for those people using services.

In most cases local authorities manage failure well at a local level, working with local providers and arranging alternative provision to make sure people continue to have their needs met. However, the financial problems surrounding Southern Cross in 2011 clearly demonstrated that it can be difficult for local authorities to manage the consequence of failure, especially where providers have a dominant market position (in size, regional presence or specialism). Consequently, to protect against this risk the Care Act 2014 requires CQC to assess the financial sustainability of such potentially ‘difficult to replace’ providers.

CQC’s Market Oversight scheme aims to do this by providing local authorities with advance notice of the cessation of one or more regulated care services as a result of the financial failure of a potentially “difficult to replace” provider. This advance notification is designed to assist local authorities in discharging their Section 48 Care Act 2014 obligations to temporarily ensure continuity of care for all people using an impacted service. In operating the scheme, CQC does not bail out failing providers, nor does it act as a lender of last resort. Equally, the scheme should not pre-empt or precipitate failure. There are currently 65 providers captured by the scheme.

In the five years that CQC has operated the scheme, a number of areas have been identified that would now benefit from being strengthened, clarified or streamlined to better reflect our legal duties. CQC has also learned from issuing two local authority notifications during this period.

The key changes to the guidance can be summarised as follows:

- Clarifying the types of activity and actions that we may take, especially the increased financial analysis and engagement that can be expected as providers progress through the operating model.

- Clarifying provider requirements and responsibilities.

- Simplifying and clarifying the local authority notification criteria, while also ensuring the guidance reflects CQC’s legal duties and our learning to date.

- Clarifying the need for CQC to have discussion with key stakeholders in certain circumstances.

- Confirming that in some instances it may be necessary to engage with third parties without the provider’s consent (for example, in cases where any delay could pose a risk to people using services).

I am grateful for the responses we received from providers, industry bodies and other parties as part of the engagement exercise that was undertaken to support this updated guidance. We have published a summary of these and taken them fully into consideration when developing this updated guidance.

Moving forward, we will continue to listen to providers and other key stakeholders to ensure that the scheme continues to deliver its purpose in the most effective way possible.

Stuart Dean

Director, Corporate Providers & Market Oversight

1. Introduction to Market Oversight

This guidance sets out information about the Scheme and our approach to operating it.

It is primarily intended for providers of adult social care in the Scheme to enable them to understand:

- What the Scheme requires of them.

- How their financial sustainability is assessed and how often we will meet with them.

- How the Scheme works through the stages of the operating model.

It should help enable other stakeholders (such as local authorities, lenders, insolvency practitioners and providers not in the Scheme) to understand:

- How we monitor ‘difficult to replace’ providers.

- What the Scheme does and does not do.

- Where we may engage with other stakeholders and seek their involvement, and what they need to do.

The guidance provides information to people who use services and the wider public, about how Market Oversight fits with the duties of local authorities to help ensure people’s needs continue to be met should a provider in the Scheme fail financially.

A separate quick guide has been published to provide an overview of the Scheme.

What is Market Oversight?

Market Oversight is a statutory scheme, as set out in the Care Act 2014, through which CQC assesses the financial sustainability of those care providers that local authorities could find difficult to replace should they fail and become unable to carry on delivering a service. We are required to inform local authorities where these services are delivered as soon as we believe that this failure is likely to happen. By giving an advance warning of likely failure, the Scheme assists local authorities in carrying out their statutory duty to ensure continuity of care when providers fail. They must do this for everyone in their area whose care needs were previously being met by that failed provider. This protects people using care services, as well as their families and carers from the anxiety and distress that may be caused by the failure of a ‘difficult to replace’ care provider and minimises any disruption to their care.

Inclusion of a provider in the Scheme is not an indication of risk; merely that the provider could be difficult for local authorities to replace, should they fail.

The Scheme is not aimed at precipitating failure and market exit. However, it is not the purpose of the Scheme to prevent business failure. The Government or CQC will not bailout failing providers or lend funds as a last resort.

The Scheme applies only to England, which is the area of CQC’s regulatory remit. It came into effect in April 2015.

How does Market Oversight link with local authority duties?

The Care Act 2014 requires that, if providers become unable to continue to deliver care to people because of business failure, local authorities must ‘step in’ and make arrangements for anyone affected so that their needs carry on being met. This includes all people using regulated care services, not just those whose care the local authority is paying for.

Any uncertainty over whether a care provider is going to be able to carry on looking after people is extremely distressing for those people as well as for their families and carers. Some of the people who use the care service may be frail and this distress could have serious implications for their health and wellbeing.

Local authorities routinely manage closures of smaller-scale services successfully. However, they might struggle with the failure of one of these difficult to replace providers for several reasons: there may be no alternative provision in the area that can support the number of people affected; or the provider might have been providing services to people across a number of different authority areas. Coordinating an effective response in such circumstances would need careful planning to ensure the welfare of the people who use those services is not put at risk. The Scheme is designed to give local authorities advance notice of potential failure so they can prepare to implement contingency plans, should their legal duty to step in become necessary.

Market Oversight statutory framework

This section briefly sets out the statutory framework that underpins the Scheme and explains our duties, functions and powers to help operate it. This includes a summary of the Regulations that support the Scheme and its operation. More detail about CQC’s statutory powers and how and when we will use them are in the description of the Operating Model. The full text of the Regulations is at Appendix B.

Sections 53 to 57 of the Care Act 2014 (‘Care Act’) establish CQC’s Market Oversight duties and functions. Under these, CQC is required to:

- Determine whether the entry criteria apply to a provider and inform them where they do, therefore creating a set of providers who are in the Scheme.

- Assess the financial sustainability of the providers in the Scheme.

- Inform local authorities where business failure is likely to lead to the cessation of at least one regulated service.

- Act proportionately and minimise burdens we impose on others.

A number of different Regulations set out in more detail the practical aspects of these duties and functions:

‘The Care and Support (Market Oversight Criteria) Regulations 2015’ set out the criteria for entry to the Scheme. The criteria are designed to be met by those care providers that, because of their size or concentration, local authorities could find difficult to replace were they to fail. The criteria relate only to how difficult a provider would be to replace and bear no relation to any judgement of actual or potential risk of failure.

Where providers form part of a wider corporate group, the size of the whole group i.e. the provider and any of its group undertakings (as defined in section 1161(5) of the Companies Act 2006 – see Glossary) will be taken into account when we assess whether the entry criteria are met. While it is the financial sustainability of individual registered providers that we must determine, matters elsewhere within a wider corporate group are likely to impact on individual registered providers, and this is something which we will take into account.

Where a provider is subject to the Scheme, ‘The Care and Support (Market Oversight Information) Regulations 2015’ set out arrangements to enable us to obtain information from other legal entities that have common ownership with the registered provider and are relevant to assessing the financial sustainability of a registered provider.

‘The Care and Support (Business Failure) Regulations 2015’ define the meaning of ‘business failure’, in relation to the temporary duties on local authorities in England under the Care Act to meet the care and support needs of adults or support needs of carers, in circumstances where care providers are unable to carry on because of ‘business failure’. They define the specific situations which we need to consider as being likely to occur (in conjunction with considering other circumstances), in coming to our decision to make a notification to local authorities. For more details on the triggers for notification, see ‘When will we notify local authorities?’.

Market Oversight operating model overview

This section sets out a high-level overview of the operating model.

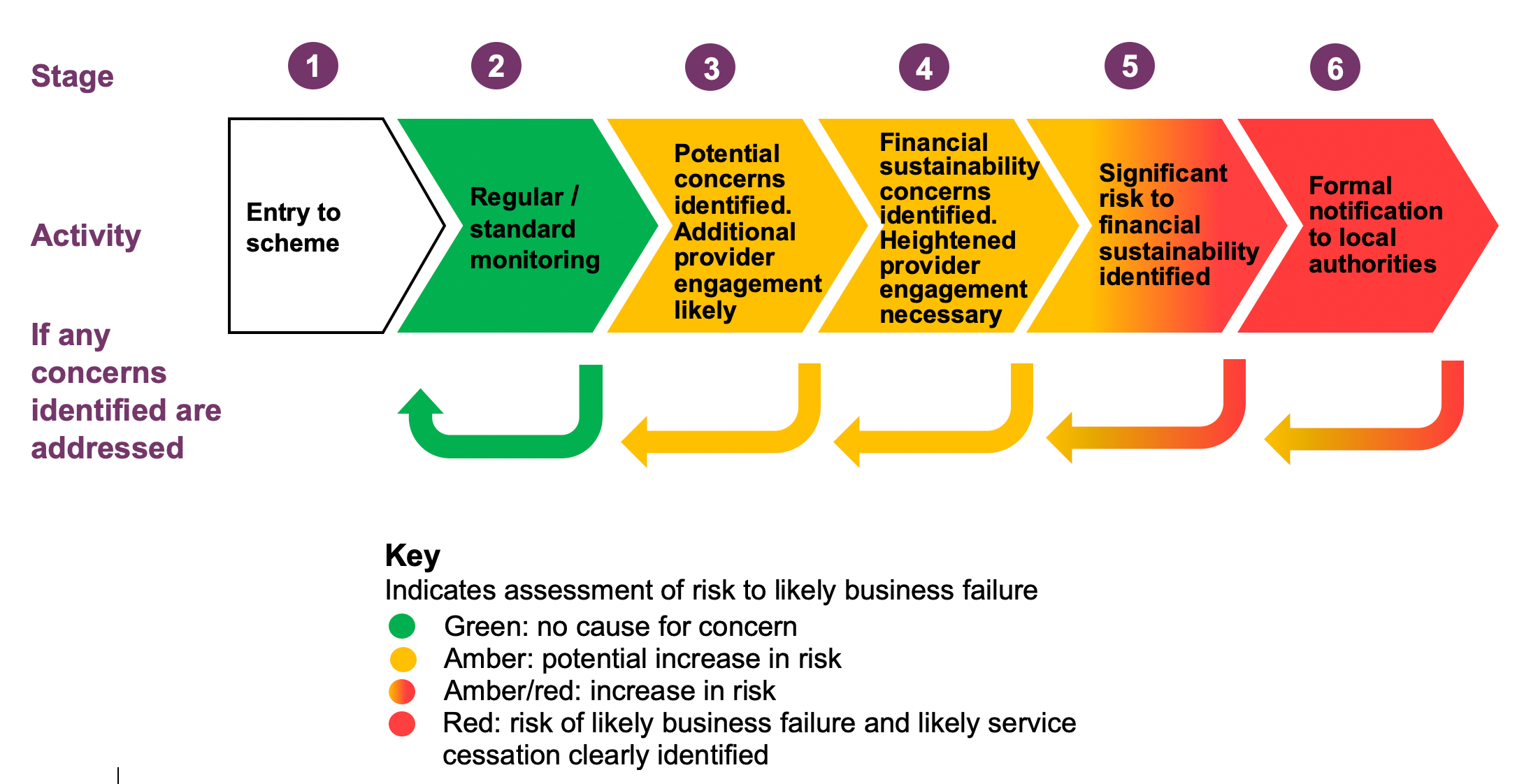

We adopt a 6-stage approach to the assessment of financial sustainability, as set out in Figure 1 below. Providers progress through the stages on the basis of our assessment of their financial sustainability. This allows us to come to a decision about the likelihood of business failure and of this leading to the cessation of at least one regulated service.

Where providers are part of a wider corporate group, we engage with senior representatives of that group and focus our requests for information (in the context of its finances, operations and business) at the appropriate corporate level – for example, the executive team of the group. This enables us to assess the sustainability of registered providers in the Scheme in the most effective and least burdensome way.

Market Oversight model

Figure 1: Market Oversight high level operating model

This diagram illustrates how our activities and engagement with providers will change if concerns about financial sustainability increase. This is a useful illustration, but the assessment process is not a ‘one size fits all’ approach. Each provider and each individual scenario require different approaches at each stage. The length of time providers spend at each stage will also vary. It is best to think of this as an ‘evolving conversation’, which grows more complex and focused as the process moves up the stages. We also recognise that providers may pass through stages quickly and that some stages may be missed out in a fast-moving situation.

We will not publish the stage in the operating model that providers are at currently, or the stages they may have been at previously. Each specific provider will have particular risks, and simply confirming the stage in the model is crude and open to misinterpretation if all facts are not known. Therefore, CQC will only disclose its assessment of financial risk to local authorities where it is under a duty to do so under the Care Act, or where it is necessary to protect and promote the health, safety and welfare of people using services.

Stages:

Stage 1 is entry to the Scheme. The provider has satisfied at least one of the entry criteria or has been included in the Scheme following a decision made by the Secretary of State for Health and Social Care to do so using powers in the Care Act.

Stage 2 represents regular/standard monitoring. Stage 2 involves us seeking regular financial and quality information from providers and routine engagement.

Stage 3: where potential concerns have been identified, further analysis of the information we hold is required. Additional engagement with the provider is also likely to be necessary.

Stage 4: where financial sustainability concerns have been identified at earlier stages, we will seek additional information from the provider to understand and assess those concerns. A heightened level of engagement with the provider will be necessary at Stage 4.

Stage 5: where the assessment of the information held demonstrates a significant risk to the financial sustainability of the provider’s business, CQC may use powers under s.55 Care Act 2014 to assess the risk to sustainability and any potential impact on the carrying on of the regulated activity. This may include requesting a Risk Mitigation Plan from the provider or appointing persons with appropriate professional expertise to carry out an independent review of the business. Engagement with the provider will be driven by necessity and will be more frequent at this stage compared to previous stages.

Stage 6: where the statutory criteria under s.56 Care Act 2014 is met we will notify local authorities that we believe are likely to be affected so they can prepare to implement contingency plans to protect people’s continuity of care should the need arise.

Throughout the model, providers can move backwards and forwards across the stages to reflect decreasing as well as increasing risks. The model works both ways.

The Market Oversight team

The Scheme is operated by an in-house Market Oversight team who work alongside the Corporate Provider Team. The Director of Corporate Providers and Market Oversight is responsible for leading both teams.

The Market Oversight team is responsible for reviewing and interpreting financial information provided and engaging with providers on financial and non-financial matters. The team also periodically makes available information to providers, which may include market trends and benchmarking.

The Corporate Provider Team regularly engages with providers who are in the Scheme about quality issues.

All providers in the Scheme are allocated named strategic, financial and operational leads.

How we will handle commercially sensitive information

Information submitted by providers for the purposes of Market Oversight is stored under strict access control and only available to staff on a ‘need to know’ basis.

We know that providers consider that most of the information that they are required to pass to CQC as a result of these duties is commercially sensitive. We cannot give any assurances that we will not, in any circumstances, disclose information we receive to a third party, including one or more local authorities. However, we will be mindful of the importance to providers of maintaining the confidentiality of commercial information so long as it does not conflict with CQC’s statutory duties.

When performing any aspect of its Market Oversight role, CQC must have regard to its overriding statutory objective: to protect and promote the health, safety and welfare of people who use health and social care services (section 3 of the Health and Social Care Act 2008). CQC will also have regard to the wider public interest in assisting local authorities in carrying out their statutory functions.

If there is any conflict between the desire to maintain the confidentiality of provider information and achieving our statutory purposes, then the statutory purposes of CQC are highly likely to outweigh treating providers’ information as confidential.

CQC has a duty to notify local authorities when we consider business failure and cessation of care is likely. Separate to that duty, we also have a discretion to disclose information to facilitate any of CQC’s functions. Disclosure is also permitted, notwithstanding any duty of confidentiality, where it is necessary or expedient to protect the welfare of any individual, or to enable another person or body (such as a local authority) to exercise their statutory functions [Section 79, Health and Social Care Act 2008].

This decision will not be one that is taken lightly, as we understand the damage that could be done to a provider from any disclosure that it is in financial difficulties and therefore may not be able to continue with its business. There will always be a clear audit trail of the decision made and CQC’s thought process behind any such step taken. This is not intended to be a blanket power for CQC to disclose commercially sensitive information to any party it chooses. The decision will always be based on the specific facts of each case, and providers will be given advance notice of a decision to disclose, unless exceptional circumstances require disclosure without notice.

From time to time, CQC may need to share information or provide updates on the operation of the Scheme to the Department of Health and Social Care (the Department) to ensure that Ministers who are accountable to Parliament are properly briefed in advance of any significant decisions on Market Oversight.

When we receive requests for information under the Freedom of Information Act (FOIA), we will consider whether we are able to release the information by referring to the FOIA exemptions [Freedom of Information Act 2000: Section 43 (commercial interests), Section 41 (information provided in confidence) and Section 31(1) (g) (where a disclosure would be likely to prejudice the exercise of a public authority's functions)].

We will consult with a provider where we receive FOIA requests for sensitive information, unless we are already satisfied that an exemption applies, and disclosure should be refused.

Any decision to refuse to release information under FOIA may be challenged by the requester making a complaint to the Information Commissioner’s Office (ICO), and subsequently to the Information Tribunal and courts. This means that any refusal to disclose could potentially be overturned.

In terms of retaining information we receive, we will hold the information we have gathered from providers and stakeholders in support of our Market Oversight duties in line with our published retention policy: https://www.cqc.org.uk/sites/default/files/20190524_IAR_Website_PDF_V4.pdf

2. How we deliver the Market Oversight Scheme

This section sets out a stage-by-stage guide to how the model will work in detail. It will explain:

- What each stage is for

- What we will do, when and how

- What happens next.

Stage 1 – Entry to the Scheme

What is this stage for?

This stage is to identify and notify providers that will enter the Scheme. There is no suggestion at this stage that providers are at any risk of financial failure, only that they meet the thresholds set out in law which suggest they would be difficult to replace.

What will we do?

There are only two routes for a provider to enter the Scheme.

-

By satisfying the criteria set out in Regulations:

The provider must be sufficiently large at a national level or have a significant local or regional presence in a number of local authority areas. Their size means that their failure to keep on providing services could challenge the continuity of care in those areas.

-

Being brought into the Scheme by the Secretary of State for Health and Social Care:

This may happen following a recommendation from a panel of individuals, selected because of their expertise in specialist services, who judge that the services the provider supplies are so specialist that, should the provider fail, local authorities would find it difficult to find temporary alternative provision for people using those services. The Department is responsible for setting up this panel and for its operation.

The Care Act gives the Secretary of State the power to include providers in the Scheme despite them not meeting the entry criteria. This is because the governing legislation is not able to describe every possible situation where a provider may be difficult to replace should it fail. In CQC, we will consider recommending to the Secretary of State that a provider should be included, even though it does not meet the entry criteria laid down in legislation, where we believe its failure would have a significant impact on people because local authorities could struggle to find a replacement for the service. Whether a provider is brought into the Scheme in this way will be decided by the Secretary of State.

Appendix C sets out the Secretary of State’s powers to ‘passport’ providers into the regime, examples of where these powers may be used and the process that will be followed.

We will assess providers against the criteria set out in Regulations (see Appendix B) to determine whether they should enter the Scheme or not.

We do this on a monthly basis for residential care providers and on a less frequent basis for providers of non-residential care. The difference is due to the information we hold about providers; we know how many beds residential care providers have through registration but do not collect care hours or numbers of clients from providers of non-residential care. In speaking with providers, we found the annual collection of this data was thought to be the most proportionate and appropriate approach. Non-residential care provision is thought to remain relatively stable unless the organisation acquires or sells parts of its business.

Regulations define the conditions a provider must satisfy in order to be included in the Scheme, as follows:

For a residential care provider, they must have a bed capacity:

- of at least 2,000 anywhere in England (i.e. significant size of provider); or

- between a total of 1,000 and less than 2,000 with at least 1 bed in 16 or more local authority areas (i.e. significant scale regionally or nationally); or

- between a total of 1,000 and less than 2,000 and where capacity in at least 3 local authority areas is more than 10% of the total capacity in each of these areas (i.e. significant concentration in a local or geographic area).

For a non-residential care provider, they must:

- provide at least 30,000 hours of care in a week anywhere in England (i.e. significant size of provider); or

- provide at least 2,000 people with care in a week anywhere in England (i.e. significant scale regionally or nationally); or

- provide at least 800 people with care in a week anywhere in England and the number of hours of care divided by the number of people provided care must be more than 30. For example, if 900 people receive care in a week then more than 27,000 hours of care must be provided in that week for the criteria to be satisfied (i.e. a higher amount of provision).

We publish information in a format that helps the public identify which brands are within Market Oversight.

Providers that enter the Scheme must remain in it for a minimum of 12 months unless removed through a decision from the Secretary of State for Health and Social Care.

Providers remain in the Scheme for this time to avoid those that are close to the boundaries of the entry criteria continually coming in and out of the Scheme. This period also gives us the opportunity to come to a reasoned assessment of the provider. It is not in the interests of people using services for a provider that dips slightly below the entry threshold to exit the Scheme before we have assessed its financial sustainability.

However, we take a proportionate approach to assessment. For instance, if a provider significantly reduces in scale, by selling part of their business, and would not necessarily still be difficult to replace, the depth and frequency of our monitoring activity reflects this until they leave the Scheme.

Where providers meet the criteria, we notify them of their entry to the Scheme by letter. We give providers the opportunity to request a review of the decision to include them in the Scheme (see below), where the basis for their inclusion is that they meet the entry criteria as laid out in Regulations.

Review of decision to be entered in the Scheme

Providers that have been brought into the Scheme because we believe they meet the entry criteria may ask for the decision to include them to be reviewed. They have 28 days from the date of the letter notifying them of their inclusion in the Scheme to seek a review. The grounds for reviewing decisions are likely to be based on factual accuracy (for example, because our records show an inaccurate number of care home beds, or we misunderstand the provider’s organisational structure).

While we are considering this request, providers remain subject to assessment under the Scheme and so must continue to comply with requests for information in a reasonable time. Decisions on reviews are made within 28 days of the request for review being made (with full supporting information) and we will notify the provider of our decision, which is final.

Appendix C sets out how providers can raise objections following a recommendation being made to the Secretary of State for Health and Social Care that they be brought into the Scheme.

Leaving the Scheme

Once 12 months have elapsed since a provider first entered the Scheme, if they no longer meet the entry criteria, they will be formally notified that they have exited the Scheme.

Stage 2 – Regular/standard monitoring

What is this stage for?

To carry out routine monitoring of providers’ finances and quality.

What will we do?

We will require providers to submit a range of information in specific formats and within appropriate timescales, to enable us to monitor their risks. Reporting requirements for Market Oversight apply regardless of any separate reporting requirements imposed on the provider, for example, as a result of their status as a charity or a public limited company. The information we ask for includes (but is not limited to):

- Business context information: on entry to the Scheme, we ask providers to supply us with their organisational structure. This is so that we can understand where the registered provider(s) sits in the wider structure and confirm the legal entities which make up the corporate group. Providers must give us this information before their first Financial Submission Template. The Financial Submission Template collects information in relation to financing structures and property ownership. We will arrange a meeting to enable us to understand the business and to allow the provider to ask questions about the Scheme. For example, this could be to obtain information on business strategy or because the provider thinks additional information is required for us to understand their business. Business context information is mainly updated via the Financial Submission Template. However, providers must inform us of material changes in a timely manner as part of our ongoing engagement with them.

- Financial information: on entry to the Scheme, providers are required to submit information on the quarterly financial performance for the previous 12 months. On entry, and annually afterwards, providers must also submit the annual budget for the current year, split into quarters. This information improves our understanding of the provider’s business and acts as a benchmark for future financial analysis. Following entry to the Scheme, providers are required to submit information covering performance over the previous quarter on an ongoing basis. Providers have 45 days, following the end of their financial quarter, in which to return this information to us. The information is gathered using the standard Financial Submission Template.

- Quality Monitoring information: following entry to the Scheme, providers have regular meetings with their Corporate Provider Relationship Manager. The purpose of this relationship is to encourage improvement and promote best practice. Providers are required to share their arrangements for operational management; quality audit and assurance; corporate governance and any corporate quality improvement plans. These are used to gain assurances on the provider’s corporate approach to improving the quality of care people receive in their services, and to contribute to the work of the Market Oversight Team in its assessment of financial sustainability. This corporate relationship also provides a forum for providers to share innovations and best practice; sector issues, risks or challenges impacting on their ability to deliver high quality care, and to provide feedback on their experiences of CQC regulation.

In addition to the provision of information, providers within the Scheme will have a number of meetings with the Market Oversight team, in addition to their meetings with their Corporate Provider Relationship Manager. The number of meetings in each year will depend on a range of factors, such as the provider’s size, performance etc.

The Financial Submission Template

The Financial Submission Template is largely based on unaudited management information to:

- Enable the calculation of standard risk indicators directly from information the provider submits.

- Identify the reasons for underperformance without the need for substantial additional information requests.

- Assist with the correlation of quality data and financial performance.

Providers have to furnish a reconciliation between the Statutory Accounts and the information submitted on an annual basis so we can check the accuracy of the financial submissions. This should be done within 45 days of the audited accounts being filed at Companies House.

The Financial Submission Template is mainly based on consolidated group financial information, i.e. the financial statements of the corporate group presented as those of a single economic entity, as it is at this level where most business failure risks are assessed. However, there are two areas where more detailed financial information is required:

- Profit and loss by activity: Where relevant, the profitability of the group is split between residential care and non-residential care activities in England, activities regulated by the Regulator of Social Housing, and other activities (for example, healthcare and care activities in Scotland, Wales and Northern Ireland or other business activities unrelated to those we regulate). This enables us to identify the areas of the business that may already be subject to financial oversight from other regulators, in order to avoid duplication of effort and to ensure there is a coordinated response if any concerns are identified. The performance of residential and non-residential services in England is also presented separately to enable the comparison of financial and quality indicators specific to these activities.

- Profitability (EBITDAM) by registered provider: Many providers will sit within a wider corporate group and the focus of our analysis will be on the group’s financial performance. However, we also need to understand profitability at registered provider level so that any loss-making providers within the group can be identified. We are not asking for more detailed information on each registered provider at this stage to reduce the administrative burden; however, additional information may be required if issues are identified.

What will we do?

We use the information contained in the Financial Submission Templates, alongside information drawn from our inspections and registration data, to calculate a standard set of risk indicators. We review the indicators as a whole, initially, to assess financial sustainability and identify business failure risks that need to be followed up with further analysis and/or engagement with the provider.

In line with our policy in relation to the monitoring of wider intelligence, we do not publish thresholds for our indicators. The financial indicators are only a small part of the overall assessment process and are open to misinterpretation if viewed in isolation.

Some of the standard risk indicators that are used are set out in detail in Appendix D and are split into the following key categories:

- Quality indicators: the results of inspections and other information we hold about providers are aggregated to identify operational issues that could have an impact on financial performance. The current quality trajectory is likely to have an impact on future financial performance.

- Trading indicators: trends in relation to sales, profitability levels and cash generation are monitored against budget and the prior year. We use these indicators to understand the relationship between a provider’s fixed and variable costs and the revenue they generate and to identify if trading performance is improving or deteriorating. Our interpretation of the trading indicators takes into account the activities performed by the provider (i.e. non-residential versus residential care) and any relevant business context information (such as the impact of new home developments).

- Debt indicators: the level of debt in the provider, including long term operating lease commitments, is assessed against standard bank lending criteria. We use these indicators to understand the affordability of the provider’s debt or debt-like obligations, and the impact this has on its ability to absorb any potential future trading risks.

- Debt payment indicators: the ability of the provider to meet its debt and lease obligations is assessed. We use these indicators to understand if the provider can afford to pay its debts as they fall due.

- Qualitative risk questions: these questions are used to identify the existence of elevated business failure risk factors, which may not be identified by looking at financial information in isolation. These questions, along with the debt payment indicators above, are the key indicators of business failure.

What happens next?

There are two potential outcomes for providers from these steps:

- Where no elevated risk concerns are identified from the standard risk indicators, providers remain at Stage 2 in a cycle of regular monitoring. This will include submitting the required financial information, business context information and quality monitoring information on a quarterly and annual basis. OR

- Where our analysis of standard risk indicators highlight concerns or potential areas of concern, including but not limited to high levels of debt, limited cash headroom, a deteriorating trading performance and a decline in quality; we will need to undertake further analysis and engagement alongside regular monitoring (Stages 3-5).

Stage 3 – Potential concerns identified, additional provider engagement likely

What is this stage for?

Where potential concerns have been identified at Stage 2. To carry out more in-depth analysis of providers’ finances and quality and to engage further with the provider as and when necessary.

What will we do?

Where the standard risk indicators show potential areas of concern, we will carry out further analysis of the information we hold to better understand the likely impact on business failure risk. This further analysis may include (but is not limited to) looking in more detail at historical trading trends, reading inspection reports, performing stress testing on key indicators (such as debt and debt payment) to understand the future impact of trading trends and market risks, and reviewing publicly available information (such as press announcements). Additional engagement with the provider is likely.

What happens next?

There are three potential outcomes for providers from this stage:

- The provider will return to regular monitoring (Stage 2) if our further analysis and/or provider’s explanations and supporting information address our concerns. OR

- The provider will remain at this stage if potential areas of concern are confirmed but appear to be under management control. OR

- The provider will move on to Stage 4 should we need to engage with providers specifically around risk, or Stage 5 should the assessment of the information held identify significant risk to the sustainability of a provider’s business.

Stage 4 – Financial sustainability concerns identified, heightened provider engagement necessary

What is this stage for?

Where concerns have been identified at Stages 2 or 3, further information will be requested from the provider. Heightened engagement will be necessary.

What will we do?

Where the review of information at Stages 2 or 3 is either inconclusive or identifies potential financial sustainability risks, we will request further information and engage with providers in order to obtain assurance and clarity as to the sustainability of the provider’s business.

This will give the provider an opportunity to explain any concerns we have identified in our analysis of the financial submissions and quality data, and the provider will be given an opportunity to respond.

Providers may be required to give us additional financial information above that required at earlier stages to help inform further, more detailed, risk analysis and to support any representations made by the provider. Examples of additional financial information we may require include (but is not limited to) the following: rolling 13-week Short Term Cash Flow (STCF), profitability by local authority contract for homecare providers, profitability by care home, monthly management accounts etc.

Engagement with a provider at Stage 4 may be relatively straightforward, for example a provider may be required to explain a change in its financial performance or capital structure, or to explain what is being done to address issues affecting the quality of services. We will seek to understand whether issues are localised or affect the whole organisation, and also what steps the provider is taking to tackle these issues.

What happens next?

There are three potential outcomes for providers from this stage:

- The provider will return to either Stages 2 or 3 if their explanations and supporting information address our concerns. OR

- The provider will remain at this stage if financial sustainability risks are confirmed but appear to be under management control. This may require closer monitoring of financial performance and may involve more frequent information requests and additional meetings with management. OR

- The provider will move on to Stage 5 if financial sustainability risks are confirmed and there is potential for them to escalate.

Stage 5 – Significant risk to financial sustainability identified

What is this stage for?

For us to gain more detailed information on financial sustainability risks, to access expert advice where appropriate and obtain and assess third party assurance – for example, HM Revenue and Customs (HMRC).

For us to understand what the next steps are for the provider, to understand the intentions of its stakeholders (for instance, lenders, landlords, HMRC and shareholders), and to monitor any debt restructuring negotiations.

What will we do?

We will continue to request financial information that was received by the provider at previous Stages but there will be additional financial and non-financial information (including service user information potentially) required at Stage 5, some of which may be from external parties.

For example, where the provider is reliant on the support of stakeholders (such as lenders or shareholders) to remain viable, we will seek assurance that the provider has their continued support. This might be through written information/evidence or it might be through meetings with these stakeholders. We will seek and consider the provider’s views before initiating any engagement with stakeholders. However, if CQC considers that it is necessary in all the circumstances, we may make contact with stakeholders, even if a provider does not consent (for example, where any delay could pose a risk to people using services).

Where the provider’s plans involve any form of business or debt re-structuring, it may be necessary to shadow the negotiations it has with stakeholders at this stage. What this effectively means is that we will be observing ongoing negotiations and restructuring proposals so that we are able to assess how these will affect the provider’s abilities to carry on regulated activities and whether our duty to notify local authorities is triggered (see Stage 6 for more detail). While the provider and other parties involved in these negotiations will undoubtedly have the interests of people using the services at the forefront of their considerations, it is important to note that our reason for observing these discussions is to assess the likely impact on those people and to make sure local authorities have the time and necessary information to respond. It is not for us to argue for, or against, any particular commercial outcome, nor is it for us to become involved in commercial discussions, except to the extent they impact on continuity of care.

To assist in our assessment of the notification criteria (see Stage 6 for more detail), we may decide to use our powers under section 55 Care Act 2014 and arrange an Independent Business Review and/or request that the provider produces a Risk Mitigation Plan. We would do this when we have concerns that the business strategy or financial position poses a risk to sustainability, or we require clarification of issues previously discussed with the provider. It is important that a provider cooperates fully with CQC and any person appointed to undertake an Independent Business Review, to enable CQC to assess any significant risks to the financial sustainability of the provider’s business.

Independent Business Reviews

Through an Independent Business Review (IBR) we would have the assistance of a person with appropriate expertise to carry out an independent review of a provider’s business. During an IBR persons with appropriate expertise provide expert insight and advice to CQC on certain aspects of a business, for example, group structure, financial performance, financial projections, restructuring plans, how a provider’s financial performance and restructuring plan may impact the provider’s solvency position and likely cessation of care, and/or future plans. This type of IBR is likely to be narrower and more focused than an IBR that may be undertaken by lenders, although we may use a broader focused review if necessary. An IBR will enable us to access specialist advice, including (but not limited to): accountants, lawyers, property consultants, actuarial consultants, turnaround consultants, insolvency practitioners and business consultants. It is important to note that CQC can recover the cost of carrying out an IBR (other than CQC’s administrative costs) from the provider.

Examples of where we may need an IBR are where:

- The provider has a complex legal or financing structure or faces other legal or financial challenges, that require specialist assessment.

- We do not have adequate visibility on current trading, which may have an influence on the provider’s risk profile.

- We aren’t being provided with information, or we are concerned about the accuracy of information received.

- The provider’s future financial position is dependent on delivering a restructuring and/or turnaround plan. An independent view is required on the risks of achieving the plan and the likely outcomes if the plan is not achieved.

- A lender’s IBR has identified specific risks.

- We need to review a provider’s Risk Mitigation Plan and reasonableness of projections underpinning that Risk Mitigation Plan.

Risk Mitigation Plan

We may require the provider to draw up a Risk Mitigation Plan (RMP) to explain how they will mitigate or eliminate any risks should current agreements with financial stakeholders fail to hold, or any required improvements in performance are not achieved. It would allow us to assess the impact of any proposed restructuring plan on the continuity and quality of regulated services. We will want to reach a view on the likely effectiveness of the mitigation plan and to assess whether our duty to notify local authorities will be triggered.

For example, a RMP may be requested where:

- The IBR has identified concerns over the sustainability of the business because debt levels are too high.

- The provider’s own projections detail that the business is not financially sustainable and it may not be able to re-finance existing borrowings.

- Lenders have stated they are looking at all their options, including contingency planning.

- The provider is in a restructuring process where a number of options are being pursued. There are conflicting objectives or a lack of consensus among the key stakeholders required to deliver a consensual restructuring.

- The proposed restructuring plan could involve formal insolvency procedures, of which the impact on the continuity and quality of care services will need to be assessed.

Interaction between an Independent Business Review and a Risk Mitigation Plan

Providers should note that a RMP is not an alternative to an IBR.

The intent of a RMP is to ensure successful risk mitigation occurs when CQC considers that there is a significant risk to the financial sustainability of a provider’s business.

An IBR is required when CQC requires a person with appropriate professional expertise to carry out an independent review of a provider’s business when CQC considers that there is a significant risk to its financial sustainability.

Providers should also note that the provision of a RMP may not negate the need for an Independent Business Review (IBR). We may also require an IBR to independently assess a provider’s RMP and the likelihood of its successful implementation as, should it be unsuccessful, there is likely to be significant risk to the financial sustainability of a provider’s business.

Conversely, we may request a RMP from a provider as the result of a specific issue related to a provider’s financial sustainability that an IBR has identified. In which case an IBR may review the reasonableness of the RMP.

What happens next?

On the basis of all the information we have gathered at these stages, we will determine whether the conditions which trigger our statutory duty to inform local authorities of likely business failure have been met. These are described in detail below.

Where we do not believe these conditions have been met, we will decide the level of ongoing monitoring required to enable us to effectively assess whether our duty to notify the local authority will be triggered. Depending on our assessment, the provider may move to a lower stage in the model or may remain at stage 5 if we continue to have concerns about significant risk to financial sustainability.

To enable effective contingency planning, providers and local authorities should be in discussion with each other regarding financial (or other) risks in the course of their normal contract management. Certain key information, such as service user data, should be readily available for local authorities to use in the event of their duties under section 48(2) of the Care Act 2014 being triggered.

We expect these discussions to take place ahead of a formal Stage 6 notification being made, to ensure the wellbeing of people receiving care is safeguarded. If providers refuse to do so, we may consider it necessary for the protection of people using services, to conduct confidential discussions with local authorities and commissioners more generally, such as NHS England and NHS Improvement (NHSEI), to ensure that appropriate contingency plans are in place.

Stage 6 – Formal notification of likely business failure and likely service cessation to local authorities

What is this stage for?

The statutory criteria set out within Section 56 of the Care Act 2014 are met.

A notification made under Section 56 seeks to provide advance warning to local authorities and NHSEI (where possible) that the business of a provider in the Scheme is likely to fail and that this failure is likely to cause cessation of one or more regulated activities.

What will we do?

In describing what we will do at this stage, we set out below when we will notify, whom we will notify, how we will notify, and what the notification will include. We will also look at when the duty of local authorities to step in is triggered.

When will we notify local authorities?

Section 56(1) and (2) of the Care Act 2014 require that, where we are satisfied that a registered provider that is subject to the Scheme is likely to become unable to carry on a regulated activity because of likely business failure, we must inform the local authorities that we think will be required to carry out the temporary duty to ensure continuity of care. The local authorities required to carry out this temporary duty are those in which the care is delivered.

There are two conditions that have to be satisfied in order to trigger this duty to notify local authorities:

- It is likely that business failure will occur; and

- It is likely that a regulated activity will cease to be carried out as a result of business failure (which may require the local authority to carry out its duty under s.48(2) of the Care Act 2014).

We do not have to prove conclusively that business failure will occur, and regulated activity will cease as a result. The primary purpose of CQC’s duty is to give local authorities advance warning that they may be required to discharge their duties under the Act. CQC will need to be satisfied that both conditions are ‘likely’, i.e. more likely than not.

Satisfying the “likely business failure” condition

Appendix B lists the situations that meet the definition of business failure as stated in ‘The Care and Support (Business Failure) Regulations 2015’ including administration and liquidation.

We will consider this condition as having been met if any of these happen (or are likely to happen) to the registered provider or any of its group undertakings as defined in section 1161(5) of the Companies Act 2006. This is because only triggering our duty to notify local authorities when that failure happens to registered providers, rather than another entity within the corporate group, such as the parent company, would undermine the intentions of the Scheme.

In complex group structures, the subsidiary companies may not initially be placed directly into administration. In order to gain control and rescue a business, an Insolvency Practitioner (IP) will determine the entity in a corporate group to be put into administration, based on what will deliver the outcome required in the most efficient and effective way. However, by placing any of the group undertakings into administration, the corporate group as a whole will have effectively failed in the eyes of the public. Also, there is an increased risk, which will be deemed likely for the purposes of Market Oversight, that the subsidiary companies (in this case the registered providers) may be subject to an insolvency process in the future.

Satisfying the “likely cessation of regulated activity” condition

Notification to local authorities will only take place when we think that they may need to step in and carry out their duty under Section 48(2) because a regulated activity is likely to cease as a result of business failure. For example, if CQC is satisfied that the services will be continued by another provider following a transfer of the business, local authorities will not be required to perform their duties under section 48 and we will not be required to serve a notice. Decisions will be made on a case-by-case basis and the specific facts will determine whether we will notify local authorities.

This does not mean that we must second-guess the ultimate decision of a local authority; the decision to trigger the local authority’s duty to ensure continuity of care is a decision solely for the local authority to make.

For example, we would consider this condition to be met if either of the following two scenarios occurred, or were likely to occur, remembering of course that this likely inability to carry on the regulated activity must always be because of likely business failure:

- The closure of a location where the regulated activity is provided.

- A location ceases to provide one of its regulated activities. For example, a location which is both a care home and a supported living service will be registered for personal care and also accommodation for nursing or personal care. If it ceases to provide the accommodation regulated activity and only delivers personal care through a supported living service, this would meet the condition.

At all stages of the assessment of financial sustainability, we maintain open dialogue with the provider and are transparent with them. There is always the opportunity for them to challenge us at any stage in the process by presenting new information which could alter the views we may form. Before we make a decision on whether a provider is likely to become unable to carry on a regulated activity because of business failure, we will normally give providers the opportunity to confirm the accuracy of the information on which we intend to base the ultimate decision on financial sustainability. However, if we are concerned that further delay may pose a risk to people using services, we will not delay matters, particularly if the information has been verified by other means.

Whom will we notify?

We will send the notifications to the Director of Adult Social Services, copying to the Chief Executive, at the local authorities which we believe may need to ‘step in’ to ensure continuity of care. These are the local authorities where people are receiving the care service – i.e. where care homes are located or where people live if they are receiving homecare. If there is any uncertainty, we will err on the side of caution and serve a notice on any local authority where, on existing information, we have reason to believe services are being received.

How will we notify?

We will choose the most appropriate means of conveying the notice depending on the circumstances of each case, but notification will usually be made by email, followed by a letter. Depending on the number of local authorities involved, we will either follow up the email with a telephone call or request confirmation of receipt.

In every case we will offer to meet or to discuss over the telephone what the implications of the notification are and what the expected next steps are likely to be. These discussions will be imperative, particularly where the impact of the failure is of significant scale, is complex or is not clear. We will ask the Director of Adult Social Services to nominate an individual responsible for day-to-day liaison with CQC about the likely failure.

Where the failure is of significant scale, we will consider setting up a briefing meeting for local authorities to attend. Representatives from the provider will also be able to attend this meeting to explain the situation in more detail.

What will the notification include?

The notification will provide as full a picture as possible as to what we believe will be the impact and timescales of the likely business failure on the registered provider’s ability to carry on the regulated activity.

In the notification, we will explain why we believe that the local authority’s temporary duty to ensure care continuity may be triggered. It will explain CQC’s statutory duties under Section 56(1) and 56(2) of the Care Act, why the conditions for notification are met, as well as a brief summary of the requirements of local authorities under Section 48(2).

Notifications will contain an assessment of the current situation and likely outcome and will highlight to local authorities where failure is not inevitable. We will clearly set out the risks of local authorities’ actions pre-empting actual failure and will promote close cooperation between them and the provider and its advisors. The notification will also remind local authorities that the act of notification itself is highly sensitive, and that it contains sensitive information that should not be shared more widely by them. Our notification to local authorities will always include:

- A clear statement that this provides as much notice as possible given the circumstances specific to the provider, giving them the opportunity to prepare to implement contingency plans, and that the next steps are for the local authority to engage with the provider/Insolvency Practitioner (IP).

- What the known intentions of any IPs are, for example, which specific care homes are at risk of closure.

- A paragraph summarising how we came to our decision that the conditions for notification (as set out above under Stage 6) have been met.

- Which business failure activity (appointment of an administrator or receiver, for instance) is considered likely to happen and when this is likely to occur.

- Which registered providers and what regulated activities are affected, and in which local authority areas they deliver care; local authorities will then be aware of which other local authorities have received the notification.

- Details on how to contact specific individuals at the provider and within CQC for further information or advice.

Who else will we share the fact of notification with?

To deliver the aims of the Scheme it may be appropriate in the circumstances to share the fact of notification with key partners who will need to support any contingency planning, such as the Department of Health and Social Care (‘DHSC’), Local Government Association (‘LGA’), the Association of Directors of Adult Social Services (‘ADASS’) and NHSEI, who will inform necessary clinical commissioning groups. Where it has been deemed appropriate for CQC to share the notification with other key partners, we will set out risks and reminders consistent with those set out above (in relation to local authorities).

We may also publish the fact of notification to the wider public to prevent people who use services and their carers and families getting different accounts of the facts. Whether we do this and the timing of it will be very carefully considered. For example, CQC will consider whether it is appropriate to delay any public announcement of a notification to reduce the risk of disruption that an announcement may cause. The potential impact on the people using the services will be at the heart of the decision to publish a notification and when to publish it.

While we are clear there are advantages in sharing the notification, there are also important aspects that would need to be handled carefully to avoid any action being taken that will pre-empt or precipitate failure. The notification is of likely failure and not definite failure. There is a very real risk that, if not handled and communicated properly, wider sharing of a notification could pre-empt a failure that may not otherwise have happened or could increase the impact of a failure. It is important that the process of notification is shared in a consistent manner and from a single source.

We will always inform the Department of Health and Social Care, and where appropriate in the circumstances, other regulators (for example, Care Inspectorate Scotland, Care Inspectorate Wales, and the Regulation and Quality Improvement Authority in Northern Ireland. Beyond that, in deciding when and with whom we share the fact of notification, we will act in a fair, reasonable and proportionate way, taking account of the specific circumstances in each case. In particular, we will consider the impact of failure and whether wider notification may adversely impact on people using the services: for instance, whether we would be likely to jeopardise the success of a restructuring plan and, in doing so, have a negative effect on a provider’s ability to deliver care.

What if business failure does not occur?

Where we have previously made a notification to a local authority, but the provider did not go on to fail or become unable to provide a regulated activity, we will ensure all those we informed of the notification are made aware of this fact. We will seek the provider’s input for how we describe this situation. As with the notification, this will be very carefully worded; we will balance the need to be transparent with the need to be clear that the previous judgement has now been re-assessed. We will not make statements about ongoing financial sustainability, however. We will only make statements that focus on the prior notification, explaining the circumstances which led us to judge that the risk of business failure was no longer likely.

When is the local authority’s duty triggered?

Whereas CQC has a statutory duty to notify local authorities when it considers that a regulated activity is likely to cease as a result of likely business failure, the local authorities’ duty to meet needs under Section 48(2) of the Care Act 2014 will only be triggered when a regulated activity has ceased following the business failure of the registered provider.

It will be for those local authorities to decide how to discharge their obligations under Section 48(2) in situations where, for example, an authority does not commission from the affected provider but is aware that other authorities do. The Department of Health and Social Care has issued guidance (see chapter 5) on this issue.

Continuing provider obligations

Following our notification to local authorities, providers are still subject to the requirements of the Scheme. They still need to comply with our requests for information and continue to engage with us so that we can monitor the ongoing financial situation and the ability to continue to deliver regulated activities. We also expect providers to enter into open dialogue with the affected local authorities, their customers and staff. We will explore this in more detail in the next section.

Roles and responsibilities in the event of business failure

The statutory duty on CQC for the Scheme is to monitor financial sustainability and, where possible, to provide an advance warning to local authorities. Should business failure happen, there are many people and organisations who will be involved in managing the consequences for people who use services and for staff delivering services.

Every business failure scenario has the potential to be different in terms of the complexity and scale of impact on the people using the service. But for every failure there are some common areas of activity that will need to be carried out, often through organisations working together.

This section briefly describes those areas and reflects on some of the key considerations that will need to be made at the time of the failure. These areas are relevant where CQC has made a formal notification to local authorities that business failure is likely and regulated activity may cease. However, there are equally relevant issues in other restructuring and sale scenarios that have not prompted formal notification, as these can also cause uncertainty for people who use services and staff.

The primary responsibility sits with the provider itself and the relevant local authorities where services are delivered. Providers, and any appointed Insolvency Practitioners, should ensure the people who use their services and their relatives, staff, commissioners and suppliers are aware of the situation and the likely impact on them. Local authorities have the duty to ensure people continue to have their care needs met if services close and will need to work with those people to make this a reality.

To support the provider and the local authorities, there are a number of national partners who can provide assistance and, where necessary, leadership in the response to failure. The four key national partners are CQC, the Department of Health and Social Care (DHSC), the Association of Directors of Adult Social Services and the Local Government Association. These will need to work very closely with the specific provider and any appointed Insolvency Practitioners.

In addition to CQC and national partners, there are other bodies that might have a role, depending on the circumstances. These range from the governments and care regulators in Scotland, Wales and Northern Ireland (where providers in the Scheme also operate there), to bodies such as provider representative bodies, NHSEI , trade unions, other providers and regulators and organisations who represent people who use services. These organisations will be engaged in the key functions we highlight below as appropriate

Alongside the core activity to ensure continuity of care for individuals using services there are three key tasks that need to be carried out in response to the failure of a care provider in the Scheme:

- Consistent and timely messaging

- Monitoring of providers

- Registration of providers.

Consistent and timely messaging

Ensuring the right people have the right information at the right time will be critical to minimise, as far as possible, people’s understandable anxiety and concern about the impact on them. It also means the right people can take the right action to ensure care can continue to be delivered.

The provider will need to ensure there is consistent and timely communication about what is happening, what the impact is and the likely next steps. Where necessary, it will need to work with the relevant local authority to do this. DHSC, CQC, ADASS and LGA will endeavour to support the provider and any Administrator (or other Insolvency Practitioner) to make sure there are effective, regular and consistent communications for some key groups, such as:

- People who use the provider’s services and their families and carers

- Staff working in the provider, and their Trade Unions

- Commissioners purchasing care from the provider

Ongoing monitoring of provider care quality

During any Administration process, the quality of care being delivered by the provider will need to continue to be monitored. This includes inspection and regulation from CQC nationally, but also local contract monitoring arrangements put in place by local authorities. The quality of care being delivered must not deteriorate in any failure, and the usual national and local measures to ensure quality will continue so that people using services can be confident of the quality of care being delivered.

CQC will continue to monitor, inspect and rate services and, where necessary, will take action to ensure services improve, using its usual approach.

Registration

Depending on the outcome of negotiations between the Insolvency Practitioner and stakeholders, such as prospective buyers, other care providers, lenders and landlords, we may need to carry out registration activity, such as new registrations, variations or cancellations. This is not necessarily only the case where we have made a notification to local authorities; the sale of a care business might occur as part of restructuring activities where regulated activities do not cease.

Following business failure, providers may need to submit applications to vary or cancel their registrations or apply for new registrations. Where new registrations are vital to ensure continuity of care to people using services, to avoid regulated care being delivered by un-registered providers, we will prioritise this work. The speed at which we will do this will not impair our ability to apply the necessary level of scrutiny required for registration.

Insolvency scenarios are fluid in nature and this can present difficulties for us in carrying out our regulatory functions. For instance, where an administrator appoints ‘caretaker’ operators in care services, there may be a period where there is no legally accountable ‘nominated individual’ who can act as a point of contact for us on regulatory matters [Regulation 6(2) of the Health and Social Care Act 2008 (Regulated Activities) Regulations 2014]. However, in matters such as these, and where possible, we will use appropriate discretion and act in the best interests of people using the service.

3. Operational arrangements

Provider obligations and responsibilities

Providers are required to submit complete and accurate information at such times, places and in such formats as CQC may specify, and to cooperate fully in any meetings or regulatory action (RMPs and IBRs) which CQC deem necessary to perform our functions under the Scheme.

Information Undertakings

On entry into the Scheme, all registered providers that are part of a wider corporate group will be required to enter into a legally enforceable agreement (called an Information Undertaking) with the corporate body which holds decision making authority for that registered provider. This commits the provider’s group undertakings (a subsidiary, a parent company or the subsidiary of a parent company) to provide us with the information we need to assess its financial sustainability. If a group undertaking is not cooperating with us, we will require one or more registered providers to enforce the Information Undertaking with them.

The standard template Information Undertaking is set out at Appendix F. The Information Undertaking should be reviewed quarterly by providers and any updates to the list of registered providers or group undertakings should be provided to CQC with regular monitoring information. The regulations which empower CQC to require these Information Undertakings are at Appendix B – The Care and Support (Market Oversight Information) Regulations 2014.

Responding to uncooperative providers

To assess the financial sustainability of care providers within the Scheme, we require providers to regularly engage with us and provide the information and explanations we request within specific timescales. Although we expect that providers will cooperate with us and comply with our requests for information (including a provider’s consent to speak with stakeholders), there may be occasions when they do not. When this happens, our first step will be to contact the provider so that we can understand the reasons for failing to comply. Where we are not satisfied with the response, we will consider taking one or more of the steps set out below.

A provider may believe they are legally prohibited from sharing information requested by Market Oversight due to contractual confidentiality reasons. However, Market Oversight’s statutory duty to oversee the financial sustainability of providers may mean that this information is essential and consequently, should it not be provided, we may consider taking one or more of the steps set out below. Decisions will be made on a case-by-case basis.

Escalation up the Market Oversight operating model

If the group undertaking fails to engage or provide the required information without good reason and within the timeframe expected, we may infer an increased financial risk and decide to escalate the provider up one or more stages in the Market Oversight model. Accordingly, this is likely to lead to closer scrutiny, wider and more frequent engagement with the provider and its stakeholders, and more detailed information requests. A failure to cooperate could ultimately lead to us notifying the relevant local authorities that we believe business failure is likely, and a regulated activity is likely to cease as a result of business failure (the two conditions for notification under Section 56 Care Act 2014).

Use of enforcement powers in Market Oversight

In addition to information undertakings and/or escalation through the Market Oversight Operating Model, we may consider enforcement actions against one or more of the registered providers within a corporate group should they fail to cooperate with the requirements of the scheme.

CQC’s Market Oversight duties, and anything CQC does to assist a local authority in carrying out its duties for continuity of care, are regulatory functions of CQC [Section 57(1) Care Act 2014]. This enables CQC to take enforcement action under Part 1 of the Health and Social Care Act 2008, in response to failures to comply with the requirements of the Scheme.

As a result, in the event of failure to comply with requirements of the Scheme, CQC may issue a Warning Notice under section 29 of the Health and Social Care Act 2008 to one or more of the registered providers in the corporate group. In line with our enforcement policy, providers are able to make representations against publication of these notices, but, even where these are upheld, local authorities must always be made aware of them and the reasons why they were issued.

Failure to comply with any requirement imposed on a provider by the Scheme may form the basis of the imposition of conditions on a provider’s registration, or in the worst case scenario, suspension or cancellation of a provider’s registration. Any such action will be independent of any enforcement action taken against providers for quality of care reasons.

Any action will be considered on a ‘case-by-case’ basis and will be proportionate.

Powers to require information and explanations

Under section 64 of the Health and Social Care Act 2008, CQC has powers to require specified persons (which includes a person who carries on or manages a regulated activity) to provide it with “any information, documents, records (including personal and medical records) or other items which the Commission considers it necessary or expedient to have for the purposes of CQC’s regulatory functions, including Market Oversight.

Under section 65 of the Health and Social Care Act 2008, CQC has the power to require explanation of any relevant matter where it considers the explanation necessary or expedient for the purposes of any of its regulatory functions, including Market Oversight.

A person who fails to comply with a request under section 64 or 65 without a reasonable excuse is guilty of a criminal offence and liable on summary conviction to a fine not exceeding level 4 on the standard scale (currently £2,500). The full text of sections 64 and 65 is at Appendix B.

Market Oversight and Registration

When determining new registration applications and certain applications to make changes to existing registrations, CQC needs to assess the applicant’s financial viability in accordance with Regulation 13 of The Care Quality Commission (Registration) Regulations 2009, i.e. the requirement that all providers must take all reasonable steps to carry on their activity in such a manner as to ensure financial viability. Since February 2018 CQC has sought assurances about an applicant’s financial viability in the form of a statement letter from a financial specialist.